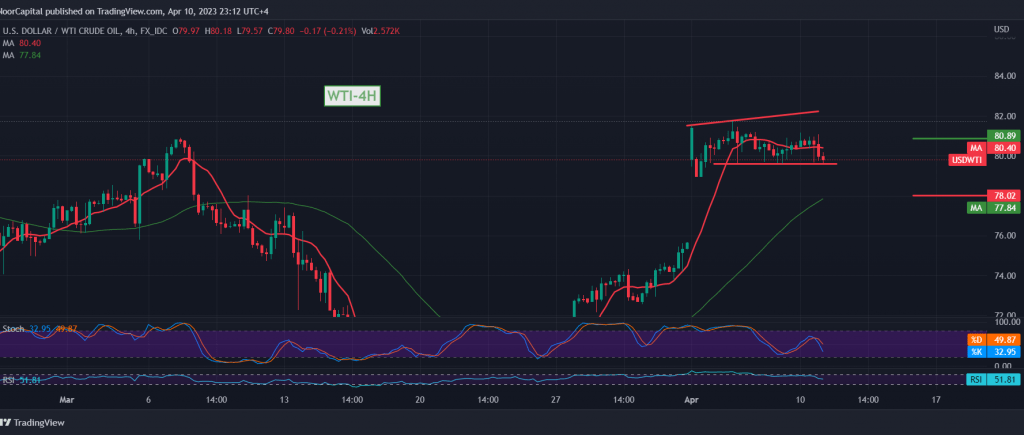

We remained neutral during the last technical report due to conflicting technical signals, explaining that risks are still high amid diverging technical indicators. As a reminder, we indicated that the price’s decline below 80.00 leads oil prices to visit 79.65, recording the lowest 79.66.

Technically, we tend to be negative in our trading, relying on the stability of intraday trading below the 80.00 barrier, in addition to the clear negative signs on Stochastic, which is stimulated by signs of declining momentum on the short time frames.

With intraday trading remaining below 80.00, and in general without the pivotal resistance of 80.00, we may witness a bearish bias during today’s trading session, targeting 79.30 as a first target, and the drop may extend the correction to visit 78.70 and 78.00, respectively.

From above, the price’s consolidation above 80.80 can thwart the suggested bearish scenario, and oil prices recover to restore the official bullish trend, with targets starting at 81.75 and extending towards 82.30.

Note: The level of risk is high and may not be commensurate with the expected return.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations