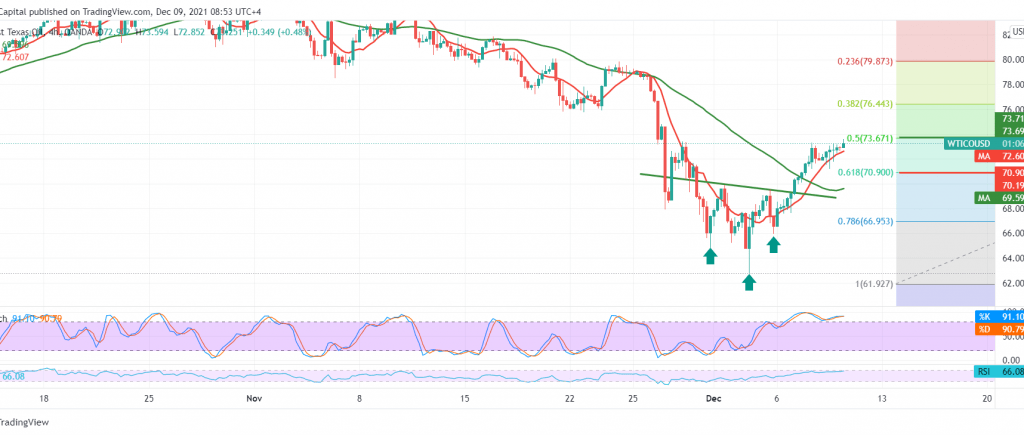

US crude oil futures prices declined significantly, canceling the expected positive outlook during the previous report, in which we relied on the stability of trading in general above 70.90, recording its lowest level at 70.30.

Technically, oil is now hovering around the 70.90 level, represented by the 61.80% Fibonacci correction, as shown on the chart, which is one of the trend keys today.

Despite the conflicting technical signals, we tend to the negativity, but very cautiously, relying on the stability of the intraday trading below 72.00. Therefore, we may witness a negative trading session, provided we break 70.30 to target 69.70, a first target, and then 68.60.

A break above 72.00 can thwart the suggested bearish scenario, and we are witnessing attempts to rise with a target of 72.50 and 73.20.

Note: The risk level is high.

| S1: 69.70 | R1: 72.50 |

| S2: 68.60 | R2: 74.20 |

| S3: 66.85 | R3: 75.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations