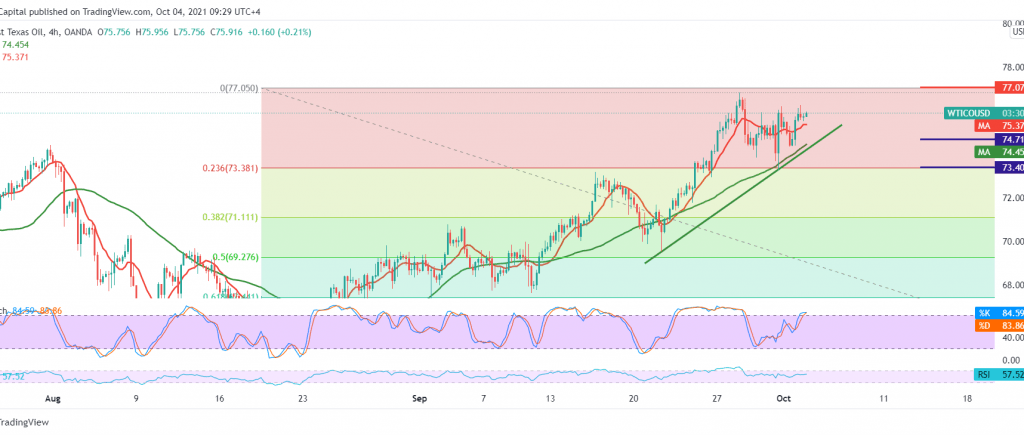

US crude oil futures continue to achieve gains for the sixth session in a row, taking advantage of building a base on the support floor of 74.60/74.70.

Technically, we tend in our trading to the positive, but cautiously, relying on the stability of trading above the mentioned support level, which is accompanied by the positive stimulus for the 50-day moving average, which continues to support the bullish price curve.

Therefore, we maintain our positive outlook, heading for a visit to 76.65, a first target. We should pay close attention and monitor the price behavior around this level because the breach increases the strength of the bullish trend, opening the way towards 77.40 initially.

To remind that the continuation of the resumption of the bullish daily trend depends on the stability of trading above 74.70/74.60, and breaking it will negate the activation of the suggested bullish scenario and put the price under strong negative pressure, with an initial aim of retesting the pivotal support 73.60/73.40, 38.20% correction.

Note: The risk level may be high.

| S1: 74.75 | R1: 76.65 |

| S2: 73.60 | R2: 77.40 |

| S3: 72.80 | R3: 78.55 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations