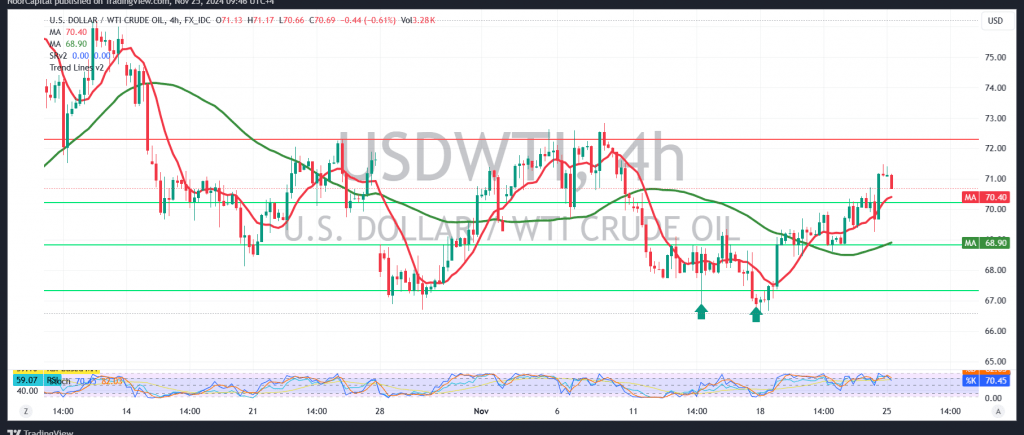

US crude oil futures closed last week’s trading on a positive note, reaching a high of $71.47 per barrel.

From a technical standpoint, the outlook remains optimistic, supported by the price’s ability to stabilize above the key support level of $70.60. Additionally, the RSI is showing attempts to gain further positive momentum, reinforcing bullish prospects.

As long as trading remains above the breached resistance, now turned support, at $70.60 and, more critically, $70.40, an upward trajectory is anticipated. The next target lies at $71.70, with a breach of this level likely to pave the way for gains toward $72.20.

However, if prices fail to hold above $70.40, and an hourly candle closes below this level, the bullish outlook may be invalidated. In this case, the price could revert to a downward trend, targeting $69.50 and potentially extending to $68.40.

Warning: The risk remains high, and returns may not align with the associated risk levels.

Warning: Geopolitical tensions persist, keeping all scenarios plausible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations