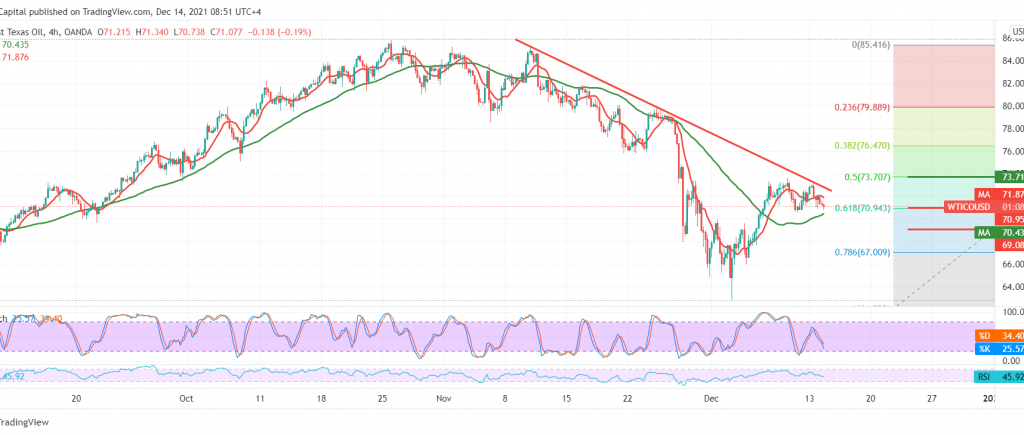

Negative trades dominated the prices of US crude oil futures contracts. It starts to pressure the pivotal support level published during the previous analysis, 70.90, explaining that breaking the mentioned level puts the price under intense negative pressure.

Technically, the RSI started losing the bullish momentum, which comes in conjunction with the negativity features that began to appear on Stochastic and gradually losing the bullish momentum.

Although we tend to the negativity, it is preferable to wait for confirmation of the break of 70.90, the 61.80% Fibonacci correction, which represents the key to protecting the bullish bias, and breaking it extends the oil losses so that we are waiting for the first price stop 70.00, and then 69.10, respectively.

Activating the suggested bearish scenario requires the intraday trading to remain below 71.80, and its breach will postpone the chances of a decline. Instead, we may witness a bullish bias that aims to retest 72.50 before repeating the decline.

Note: The risk level is high

| S1: 70.00 | R1: 72.45 |

| S2: 69.10 | R2: 73.00 |

| S3: 67.60 | R3: 74.85 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations