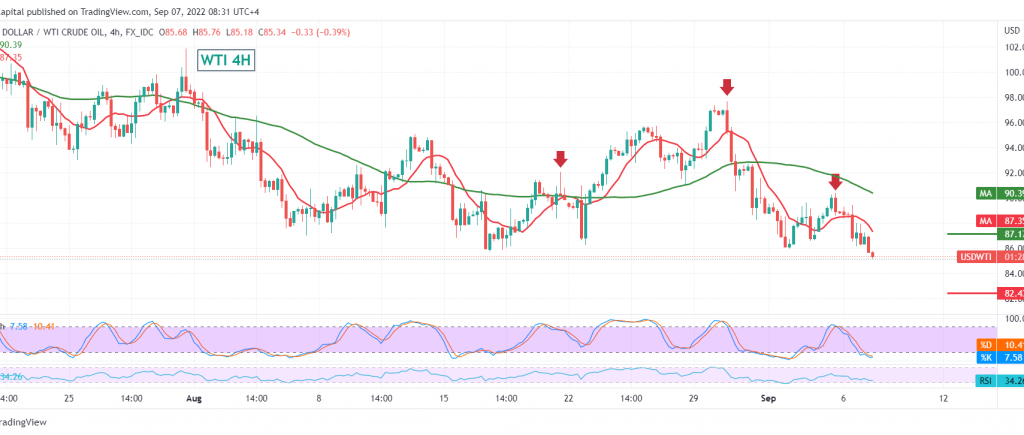

US crude oil futures prices declined yesterday, nullifying the expected positive outlook, in which we depended on the stability of intraday trading above the 88.00 level, touching the stop-loss order published in the previous analysis at 87.80. We made it clear that breaking the mentioned level puts the oil price under strong negative pressure, with targets starting at 87.00 to visit 86.40, recording the lowest level at 85.30, compensating for the losses of the long position.

Technically, oil prices failed to maintain trading above 87.00 level, accompanied by the negative pressure of the simple moving averages that pressure the price from above, in addition to the signs of the bullish momentum confining on the short time intervals.

From here, the bearish scenario remains the most likely, targeting 83.90/84.00 the first target. Breaking it will facilitate the task required to visit 83.00, an awaited next station, unless we witness any trading above 87.00.

Attempt to consolidate above the previously broken support floor 87.00 will postpone the chances of a decline, and we will witness a temporary recovery that aims to retest 88.10 initially.

Note: The report issued by the International Energy Agency on oil stocks has been postponed to tomorrow’s session.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations