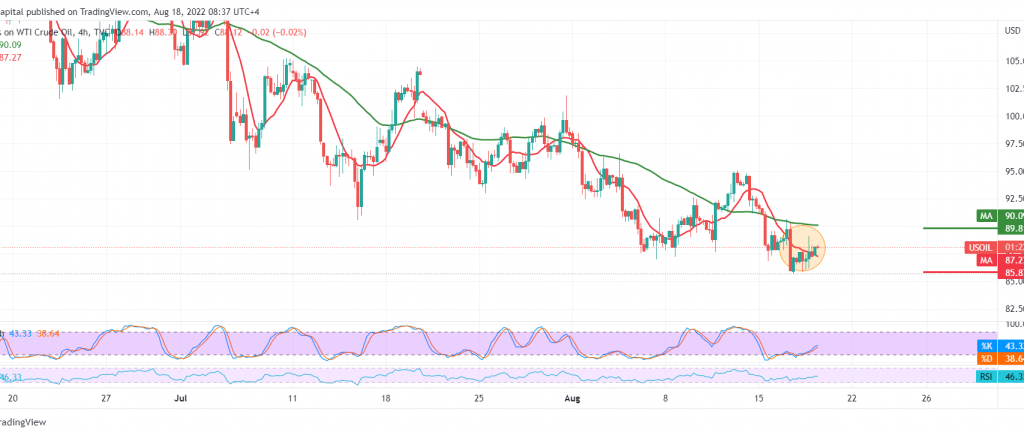

Negative trading dominated the US crude oil futures prices within the expected bearish context, during which we targeted 85.00, to be satisfied by recording the lowest level at 85.40.

Technically, the current oil movements show a bullish tendency after finding a good support floor near 86.00 accompanied by positive signs from the 14-day momentum indicator on the short time frames.

We may witness a cautiously limited bullish bias in the coming hours to retest 88.50 first target, and breaching it may push oil to start forming a bullish corrective attack towards 89.10 and extend to visit 90.00.

Activating the suggested scenario depends on the stability of trading above 86.00 and, most importantly 85.80, knowing that breaking the latter leads oil to the official descending path. Therefore, we wait for a barrel of oil at around 85.00 and 84.00 next stations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations