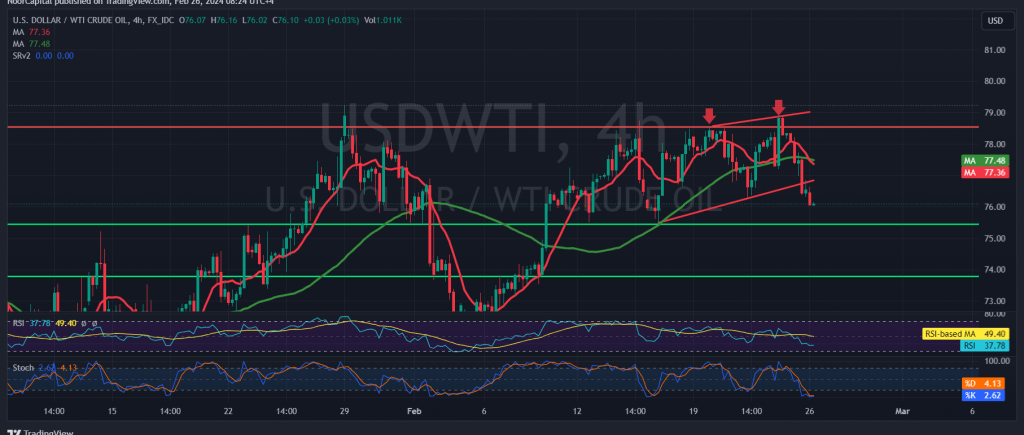

US crude oil futures prices faced significant downward pressure towards the end of last week’s trading, failing to maintain stability above the crucial psychological barrier at $78.00. This development negated the anticipated positive outlook. In the previous technical report, we highlighted that breaching the support level at $77.35 would nullify the bullish scenario, leading to negative pressure. As expected, the price dipped to its lowest level at $76.08 per barrel during early trading in the current session.

From a technical perspective, examining the 4-hour chart reveals the reemergence of the simple moving averages exerting downward pressure on the price, acting as a barrier. Particularly, the 50-day simple moving average intersects near the resistance level at $77.60, reinforcing its strength, exacerbated by the declining momentum observed on the Stochastic indicator.

Consequently, we anticipate a bearish bias in the upcoming hours, targeting $75.40. A breach below this level would extend the losses, paving the way towards $74.60.

It’s crucial to note that regaining stability above the resistance level at $77.60 would promptly halt the downward trend, facilitating a recovery in oil prices towards $78.40 and $79.10 as the subsequent stations.

Warning: Given the prevailing geopolitical tensions, there is a heightened level of risk, potentially resulting in increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations