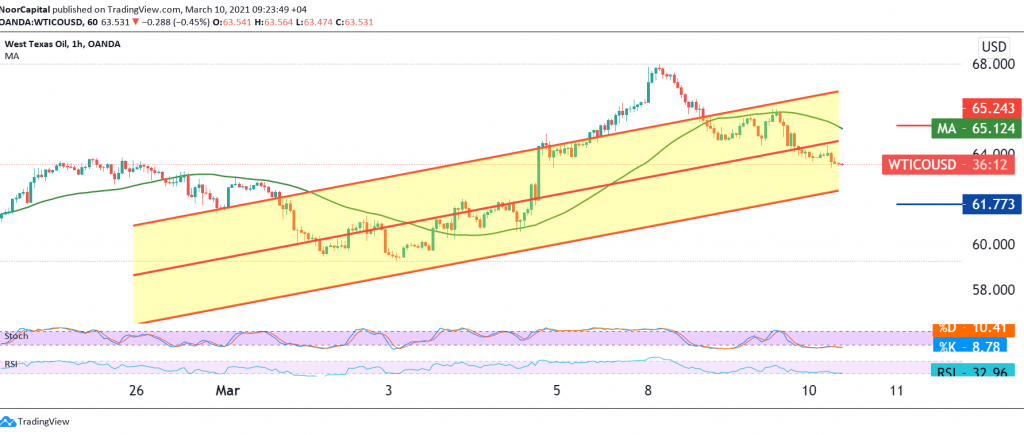

US crude oil futures prices declined significantly yesterday, after several consecutive sessions of the rally, to find a strong resistance level near 66.00.

Technically, with a closer look at the short time frames, we find the RSI indicator lost the bullish momentum, which comes in conjunction with the negative pressure from the 50 day moving average. Therefore, the bearish bias is likely today, targeting 62.60 / 62.50 a first target, bearing in mind that breaking the latter increases and accelerates the strength of the daily bearish bias, opening the way to a visit of 61.70.

From the top, to move upwards and rise again above the previously broken support, which was converted into a resistance level, according to the concept of role-swapping at 64.50, which delays the chances of a reversal, and we may witness a re-test of 65.20.

Note: Today, we are awaiting the report issued by the International Energy Agency on oil inventories, and we may witness high volatility in prices.

| S1: 62.60 | R1: 65.20 |

| S2: 61.70 | R2: 66.85 |

| S3: 60.00 | R3: 67.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations