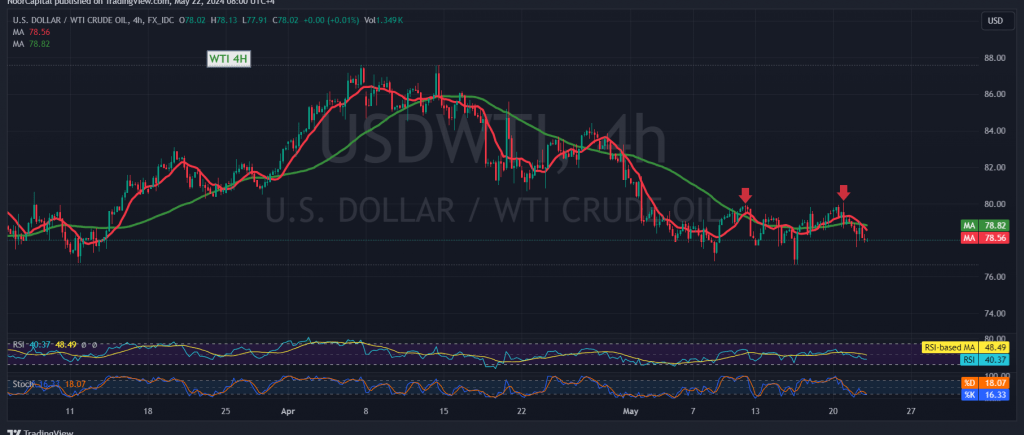

US crude oil futures experienced a downward trend in the previous session, encountering resistance at $79.60 per barrel, leading to significant declines and reaching a low of $77.67.

Technical Analysis

Our outlook remains bearish, based on the following technical factors:

- Resistance Levels: Intraday trading remains below the key psychological resistance level of $79.00, and more broadly below $79.60.

- Moving Averages: The negative intersection of simple moving averages suggests continued downward pressure.

Downward Targets

Given these technical signals, the downward trend is likely to persist, with the following targets:

- First Target: $77.40. Breaking below this level could intensify the decline.

- Subsequent Target: $76.75.

Potential Reversal

On the upside, if prices consolidate above $79.60, the bearish trend could be halted. In this scenario, crude oil prices might recover, initially targeting $79.90.

Market Volatility Alert

Today, we anticipate significant market volatility due to the release of critical economic data from the United States, particularly the Federal Reserve Committee meeting results. Additionally, ongoing geopolitical tensions contribute to a high-risk environment, potentially leading to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations