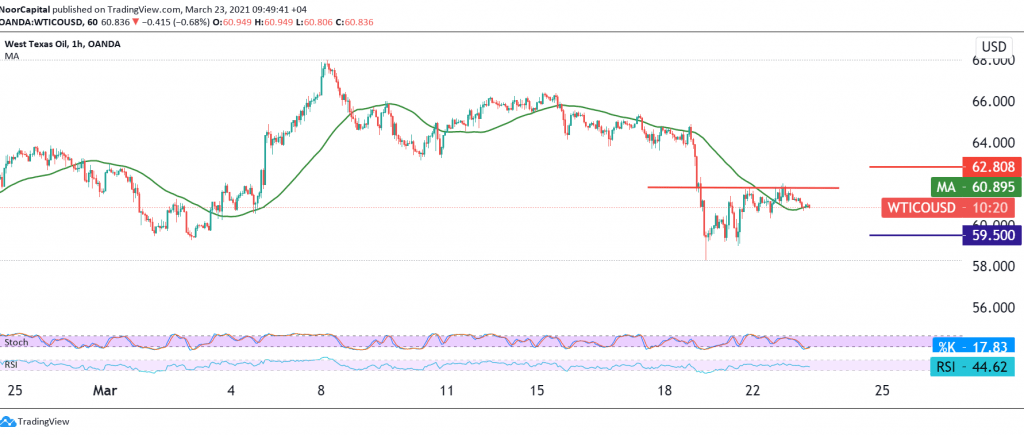

US crude oil prices found a strong resistance level represented in the second target published during the previous report at 62.00, which forced it to trade negatively again.

Technically, the intraday trading remains below the resistance level 61.60 / 61.50 supports the intraday negativity accompanied by the continuation of the negative pressure from the 50-day moving average.

Consequently, we may witness a bearish bias during the coming hours, targeting 60.10/60.00, knowing that confirming the recent breakout extends oil’s losses to 59.40, the next stop.

A reminder that surpassing the upside and rising above 61.80 is capable of foiling the bearish scenario, and crude oil regains its recovery with an initial target of 62.70.

| S1: 60.10 | R1: 61.80 |

| S2: 59.40 | R2: 62.70 |

| S3: 58.40 | R3: 63.45 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations