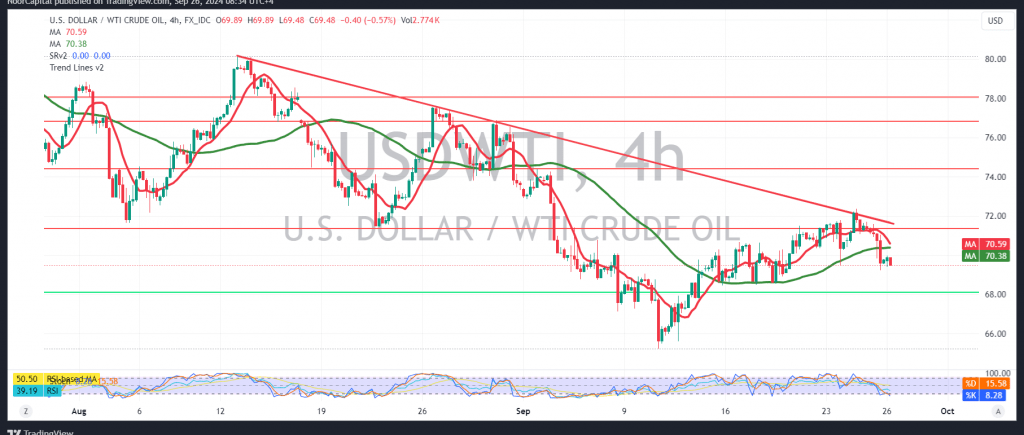

Negative pressure dominated US crude oil futures prices during last Wednesday’s trading, erasing recent gains and reaching a low of $69.28 per barrel.

From a technical perspective, the outlook remains cautiously negative, influenced by the bearish crossover of the simple moving averages, which are exerting downward pressure on the price. Additionally, the price is currently trading below the previously broken support level of 70.50.

We may see a bearish trend in the coming hours, provided there’s a clear break of the 69.20 support level, targeting 68.65 as the initial target. Given the elevated risks, we will limit our target to this level.

On the upside, an upward crossover and price stabilization above 70.40 could prompt oil prices to regain an official upward path, with targets set at 71.10 and 71.95.

Warning: The risk level may be high.

Warning: Today, we anticipate high-impact economic data from the US, including non-farm private sector jobs data, weekly unemployment claims, and the ISM services PMI. This could result in significant price volatility at the time of the news release.

Warning: The risk level is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations