US crude oil futures prices succeeded in touching the first target published in the previous analysis, located at 70.65, to record the lowest level at 70.75, to return to the bullish rebound as a result of hitting the support level.

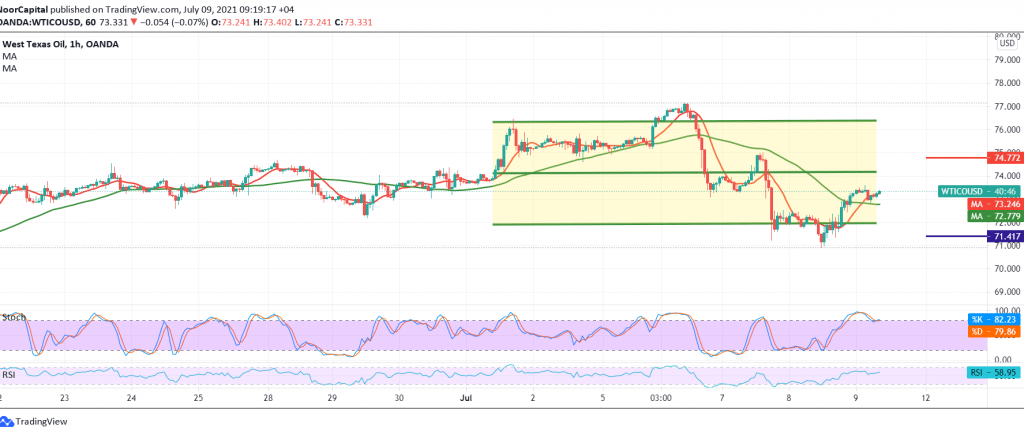

Technically, we tend in our trading to the negative side, relying on the clear negative signs on the stochastic indicator, which is accompanied by the negative pressure coming from the 50-day moving average.

From here, and with the stability of trading below 73.90, the bearish bias is the most preferred, targeting 71.50, the first target, taking into account that the price stability below the latter leads oil to complete the bearish correction tendency with a target of 69.75.

Activating the suggested scenario requires trading to remain below 73.90, and its breach may lead oil to enter recovery attempts with targets of 74.15 and 74.70, respectively.

Note: RSI tends to be positive on short intervals.

| S1: 71.50 | R1:74.15 |

| S2: 69.75 | R2: 75.15 |

| S3: 68.80 | R3: 76.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations