U.S. crude oil futures extended their decline for the fourth consecutive session, reaching a two-week low near the $65.00 per barrel mark.

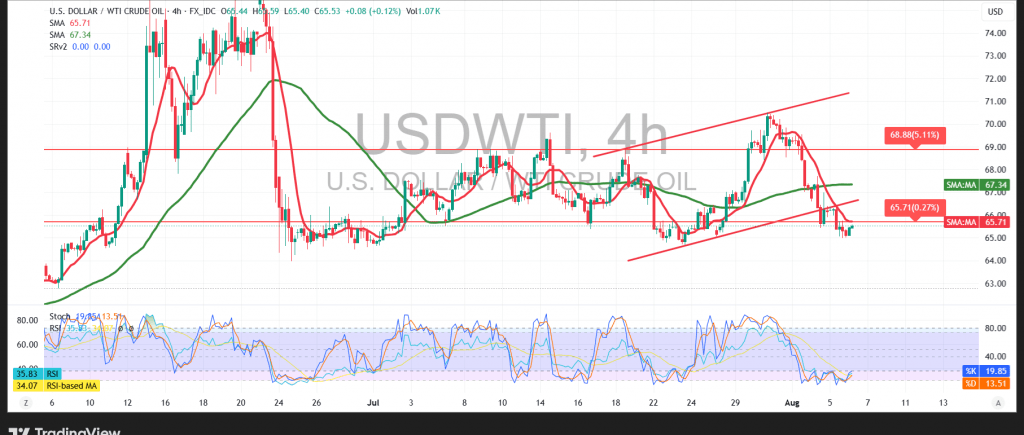

Technical Outlook:

Intraday price action shows a modest rebound attempt as oil tries to recover from oversold conditions. However, the 50-period Simple Moving Average (SMA) continues to act as a dynamic resistance level, capping any meaningful recovery. The broader technical structure remains bearish, with the downtrend still firmly in control.

Likely Scenario:

As long as the price remains below the $66.20 resistance level, the bearish bias is expected to persist. A break below the $65.00 support would likely accelerate the downward move, targeting $64.35 as the next support zone.

Alternative Scenario:

A confirmed breakout and close above $66.20 could temporarily ease the selling pressure and trigger a corrective rebound toward the $67.00 resistance level.

Warning:

Risk remains elevated amid ongoing geopolitical tensions and trade-related uncertainty. Traders should prepare for increased market volatility and adopt appropriate risk management strategies.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations