US crude oil futures have reached the official target outlined in our previous technical report, hitting a low of $66.67 per barrel after touching the 67.00 mark.

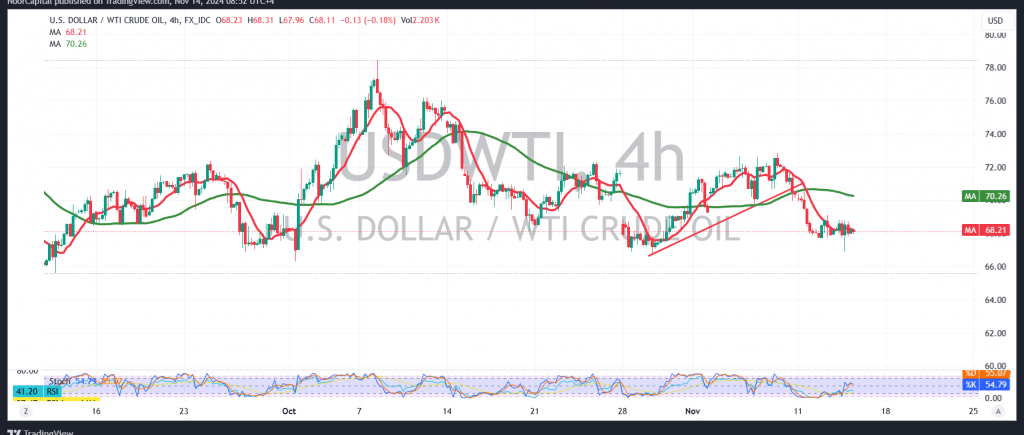

From a technical standpoint, the 4-hour chart indicates that oil attempted an upward rebound upon testing the psychological support at 67.00. Nevertheless, despite this rebound, the price remains constrained below the significant resistance level of 68.60, with simple moving averages exerting downward pressure from above.

Accordingly, a bearish scenario is expected to prevail in the near term, contingent on a clear break below the 67.00 support. Such a break would likely pave the way toward the initial target of 66.10, with potential further losses down to 65.30.

However, for this bearish outlook to remain valid, oil must sustain levels below 68.65. If the price closes an hourly candle above this threshold, it could temporarily invalidate the downtrend, opening the possibility of a short-term upward wave targeting 69.00 and then 69.80.

Caution: The risk level is considerable and may not align with the potential returns.

Risk Alert: The release of high-impact US economic data, specifically the “Consumer Price Index – Annual and Consumer Price Index – Monthly,” could result in significant price fluctuations.

Geopolitical Risk Warning: The ongoing geopolitical tensions contribute to a heightened level of risk, with multiple scenarios remaining plausible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations