During the previous trading session, mixed trading dominated the US crude oil futures prices. As a reminder, we indicated that the level of risks might be high and not commensurate with the expected return.

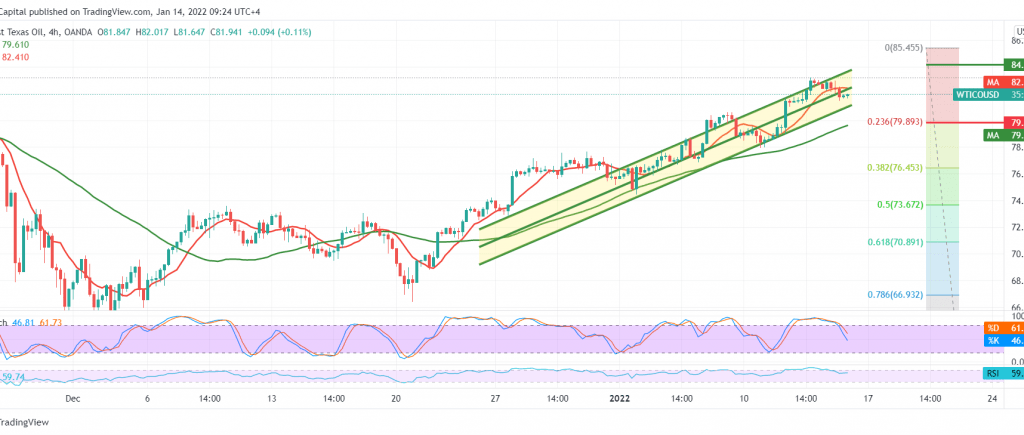

Technically, the trades witnessed a bearish tendency after several consecutive sessions of ascending to hit the resistance level 83.00, in addition to the intraday trading pivot below 82.50.

Looking at the 60-minute chart, we notice the discrepancy between the negative pressure of the simple moving averages, which wants a bearish slope, and the positive signs that started appearing on the stochastic indicator.

Therefore, we prefer to stand on the sidelines, although we tend to be negative, but we wait for a clearer signal waiting for one of the following scenarios:

The decline below 81.20 puts the price under intense negative pressure, and the probability of 80.50 and 80.10 will appear, respectively, it may extend to retest the long positions 79.80, 23.60% correction.

Trading above 83.10 may lead the price to regain the bullish path, with targets that start at 83.50 and extend towards 84.10.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 81.20 | R1: 82.65 |

| S2: 80.55 | R2: 83.50 |

| S3: 79.70 | R3: 84.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations