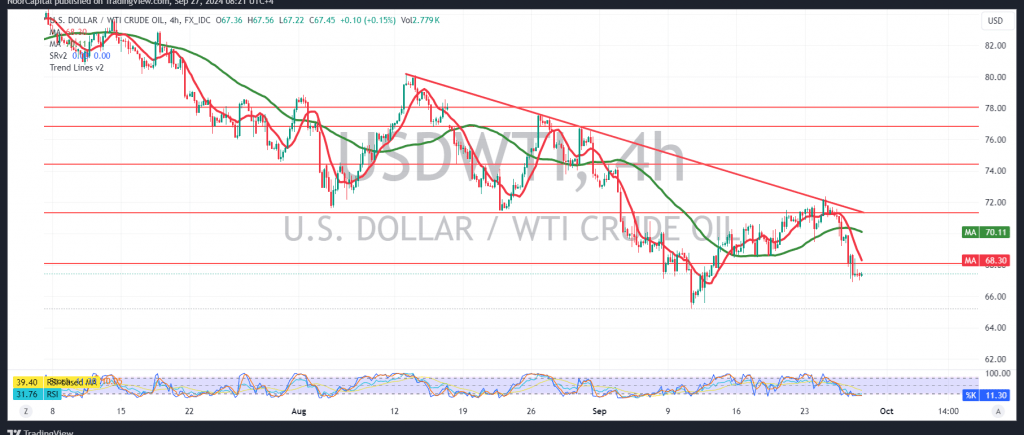

U.S. crude oil futures declined significantly, following the downward trend mentioned in the previous report, exceeding the official target of 68.65 and recording a low of $66.967 per barrel.

From a technical perspective, we lean toward a negative outlook but with caution, relying on the continued negative crossover of the simple moving averages that exert downward pressure on the price, alongside the stability of momentary trading below the previously broken support level of 69.30.

A downward trend may emerge in the coming hours, with 66.30 as the first target. A break below this level would likely extend oil’s losses, opening the path directly toward 65.20.

On the upside, an upward move and price consolidation above 69.30 would lead oil prices to regain the official upward trend, targeting 71.10 and 71.95.

Warning: The risk level may be high.

Warning: Today, we expect high-impact economic data from the US, specifically “Core Personal Consumption Expenditure Prices – Annual,” which could cause significant price volatility at the time of the news release.

Warning: The level of risk is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations