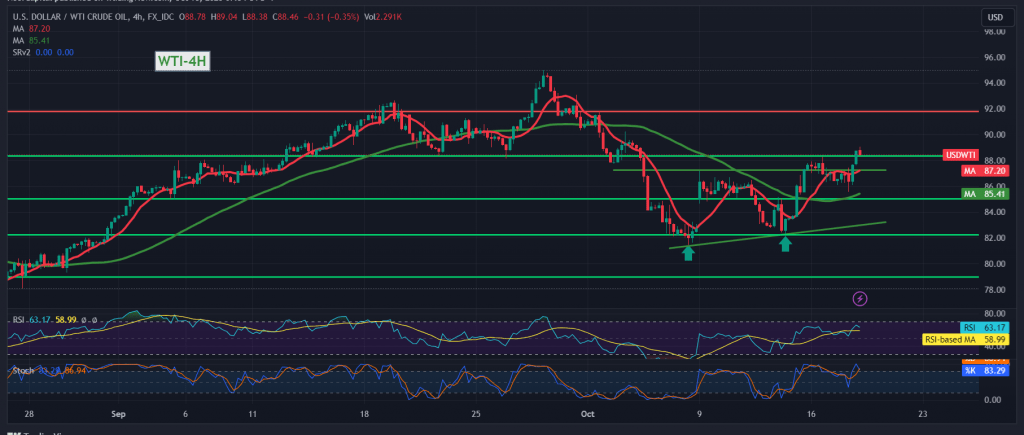

The main support level published during the previous technical report at 85.65 succeeded in pushing the prices of US crude oil futures contracts to a solid upward rebound within the expected positive outlook, touching the first official target of 87.80, reaching the second stop of 89.10, and recording its highest level of 89.05 during the morning trading of today’s session.

Technically, we find oil prices stable momentarily above the 87.20 level, and the simple moving averages returned to hold the price from above and support the continuation of the upward curve for prices, stimulated by positive momentum signals on short time frames.

From here, with the stability of trading above 86.40, we are encouraged to maintain our positive expectations towards the rest of the targets of the previous report: 89.90, the first target, and then 91.10, knowing that confirmation of the breach of 91.50 extends the gains as we wait for 93.20, the next target.

Sneaking below 86.40 postpones the chances of a rise, and we may witness a retest of 85.65 before attempts to rise again. and you must pay close attention if 85.65 is broken, as this puts the price under rapid negative pressure towards 84.30 and 83.00.

Note: The level of risk may be high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations