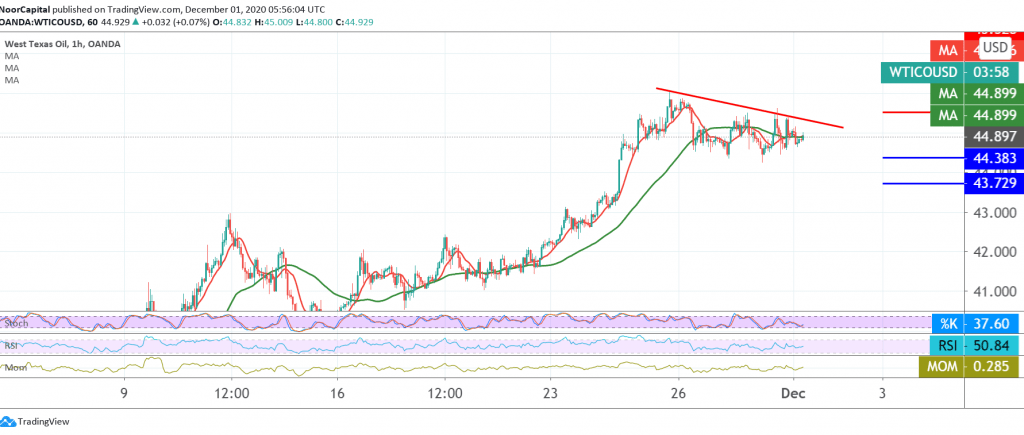

Mixed trades dominated the movements of US crude oil futures during the previous session’s trading within a downward trend. Technically, we tend to be negative in our trading, relying on trading stability below the extended resistance level 45.50 / 45.75, in addition to the gradual loss of the bullish momentum on stochastic.

Therefore, we await a bearish bias during the coming hours, whose initial target is located around 44.40, knowing that the confirmation of the breach of the aforementioned level forces the price to enter a bearish correction that targets 43.70.

Only from the top, the stability of trading again above the resistance level of 45.75 negates the activation of the scenario of the expected bearish correction, and oil will recover again with targets of 46.45 / 46.50 and may extend later towards 47.00.

Note: The level of risk may be high.

| S1: 44.40 | R1: 45.75 |

| S2: 43.70 | R2: 46.45 |

| S3: 42.00 | R3: 46.20 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations