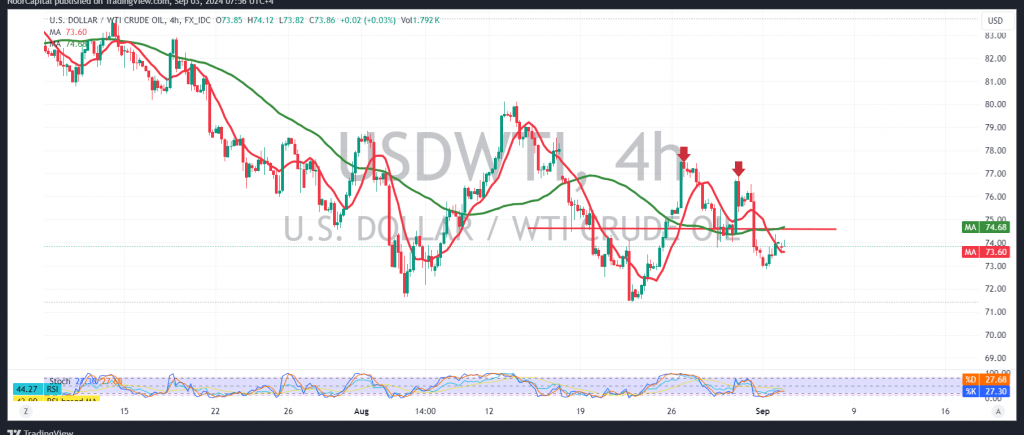

U.S. crude oil futures have experienced a significant decline, marking the worst monthly performance since the beginning of the year. Oil prices lost nearly 6.15% during August, reaching a low of approximately $72.90 per barrel yesterday.

From a technical standpoint, the 4-hour chart reveals a bearish pattern, suggesting a continued downward trend. This is further supported by persistent negative pressure from the simple moving averages.

As long as trading remains below the resistance levels of 74.60 and, more importantly, 75.00, the bearish trend is expected to persist, with an initial target of 73.10. A break below this level could accelerate the downward momentum, opening the way toward 72.20.

However, an upward move and price consolidation above 75.00 could invalidate this bearish scenario, potentially leading to a positive trading session with initial targets around 76.00.

Warning: The risk level may be high, particularly amid ongoing geopolitical tensions, which could lead to significant price volatility.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations