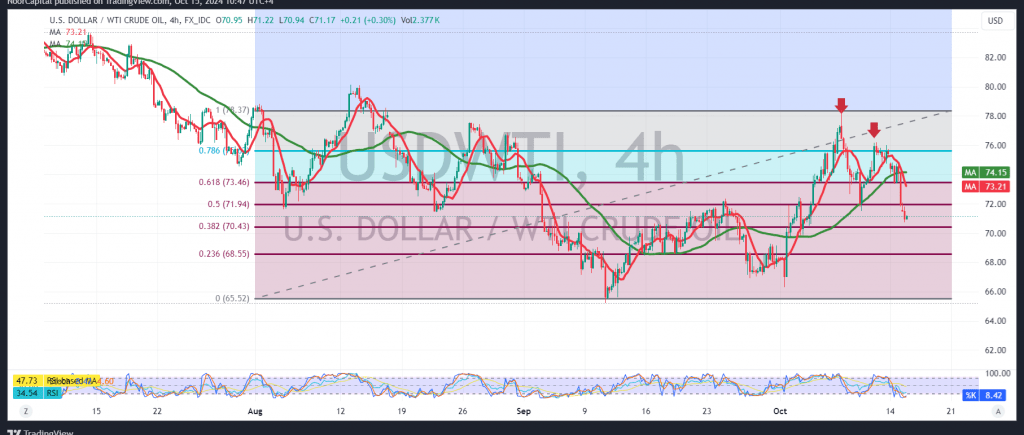

U.S. crude oil futures experienced significant losses at the start of the current week, surpassing the previous target of 71.90 and reaching a low of $70.78 per barrel.

A bearish technical pattern, specifically a double top, is evident on the 240-minute chart. This, combined with persistent downward pressure from the simple moving averages, supports the likelihood of continued bearish movement. As long as trading remains below 72.10, the bearish trend is expected to continue, with 70.60 as the first target. A break below this level could further accelerate the downward momentum, potentially opening the way for a move toward 69.65.

However, if the price stabilizes above 72.10, and especially above 72.20, it may invalidate the bearish scenario. In this case, oil prices could temporarily recover and aim to retest the 73.60 level.

Warning: The risk level is high due to ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations