Bleeding losses continue to control the prices of US crude oil futures contracts within the expected negative outlook, exceeding the official target required to be achieved during the last report, located at the price of 68.45, recording its lowest level during the early trading of the current session at the price of $63.73 per barrel.

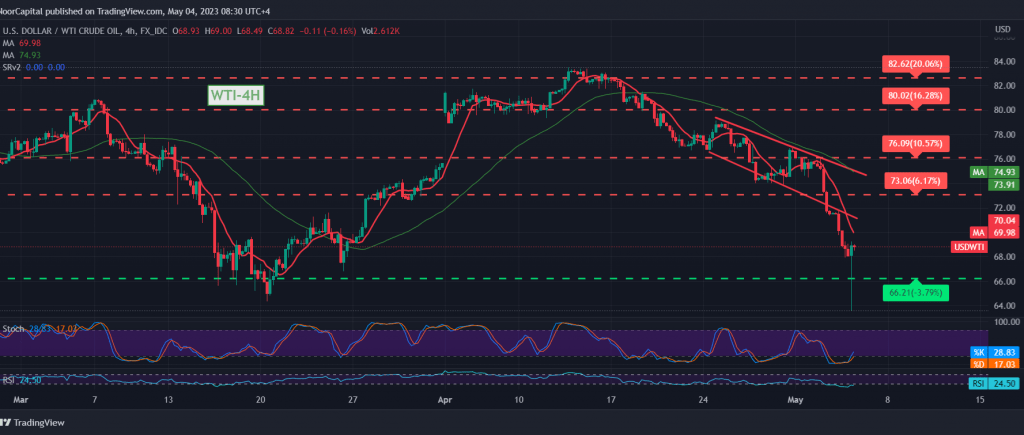

Technically, prices are currently trying to compensate for some losses after the bullish rebound due to touching the 63.80 level. Despite the continuation of the negative intersection of the simple moving averages, we believe that there is a possibility of a slight bullish bias in the coming hours, depending on the emergence of some positive signs on the stochastic indicator, which may push the price to re-test 70.20 and 71.20 respectively.

It should be noted that the limited bullish bias does not contradict the general bearish trend, whose official targets are around 64.50.

Note: The level of risk is high and does not match the expected return, and careful consideration is required, bearing in mind that all scenarios are likely to occur.

Note: Today, we are awaiting high-impact data issued by the euro area, “interest rates, the European Central Bank monetary policy statement and the European Central Bank’s press conference,” we may witness high price volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations