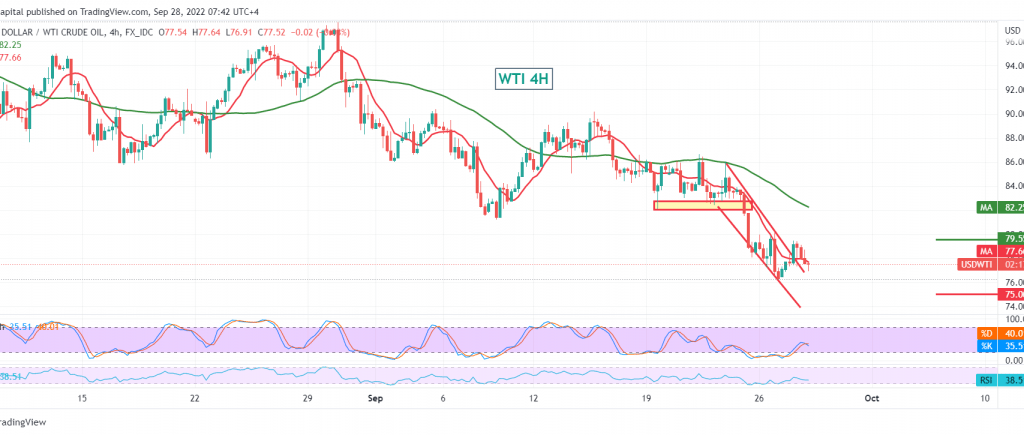

US crude oil futures prices temporarily reversed the expected bearish trend, in which we relied on price stability below 78.00 areas. We indicated that the attempt to cohesion and stability above 78.00 leads the price to recover temporarily, targeting 79.50, to record oil prices as high as 79.45, compensating for the short position.

Technically, the simple moving averages continue their negative pressure on the price from above and support the decline, in addition to the price returning to stability below 78.00. On the other hand, we find the 14-day momentum indicator that started to provide positive signals on the short time frames.

With technical signals conflicting, we prefer to monitor the price behavior to be in front of one of the following scenarios:

Stability below 76.90 leads oil prices to achieve losses that start at 76.10 and extend later towards 75.50.

Above 79.10, and most importantly 79.50, we may witness a positive trading session, with targets starting at 80.80.

Note: The risk is high.

We remind you that we are awaiting the report issued by the International Energy Agency on oil inventories, and we may witness high volatility in prices.

Note: We are awaiting the Federal Reserve’s speech later in today’s session, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations