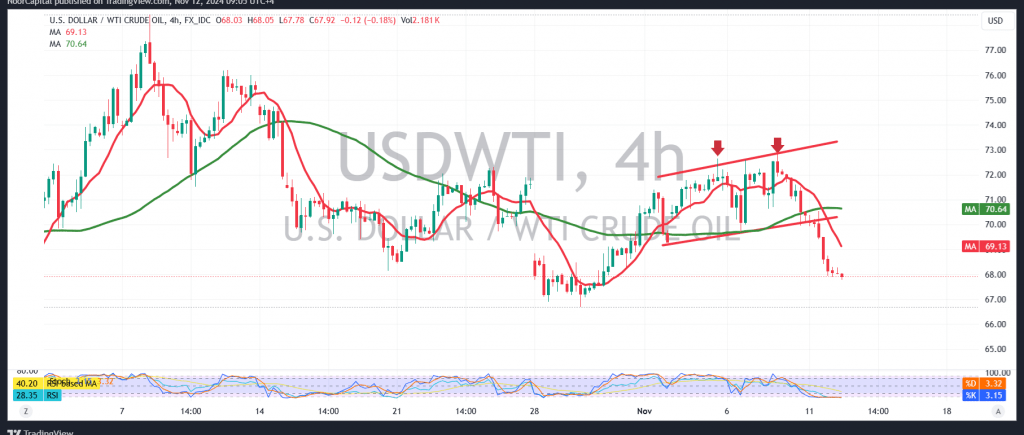

US crude oil futures prices experienced a significant decline in the last trading session, aligning with the bearish outlook, and met the forecasted targets at 68.55, hitting a session low of $67.84 per barrel.

Technical Analysis:

- Bearish Bias: Oil prices are currently under negative pressure, with trading stability below 68.60. The downside potential is reinforced by the price’s movement beneath the 50-day simple moving average.

- Key Targets: The bearish scenario remains favored for today, with a primary target of 67.00. A breakdown below this level could intensify the downtrend, paving the way toward 66.10 as the next major support.

- Upside Risk: The bearish outlook would be challenged if oil prices stabilize above 68.65 and close an hourly candle above this level. In such a case, we might see an attempt to form an upward wave, targeting 69.70 and extending to 71.45.

Warnings:

High Risk: Volatility may be significant, and the risk level is high, especially with geopolitical tensions influencing the market. Careful risk management is essential.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations