US crude oil futures prices jumped by the end of last week’s trading to achieve noticeable gains during the American period, recording a high of $83.26 per barrel.

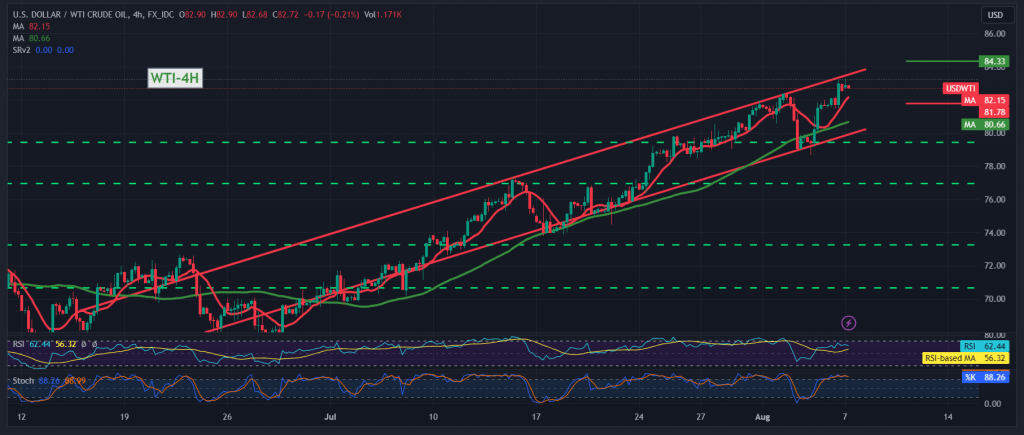

Today’s technical outlook. Closer looking at the 240-minute chart, we notice the continuation and regularity of work within the bullish channel and the positive intersection of the simple moving averages that support the daily bullish price curve.

From here, with steady daily trading above the strong support floor 81.80, the bullish trend is the most likely, provided that we witness a clear and strong breach of the resistance level of 83.45, which is a motivating factor that enhances the chances of visiting 84.20, the first target, and then 85.20, the next official station, unless we witness any trading below 81.80.

Closing the hourly candlestick below 81.80 puts oil under temporary negative pressure, aiming to retest 81.00 & 80.80 before starting the rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations