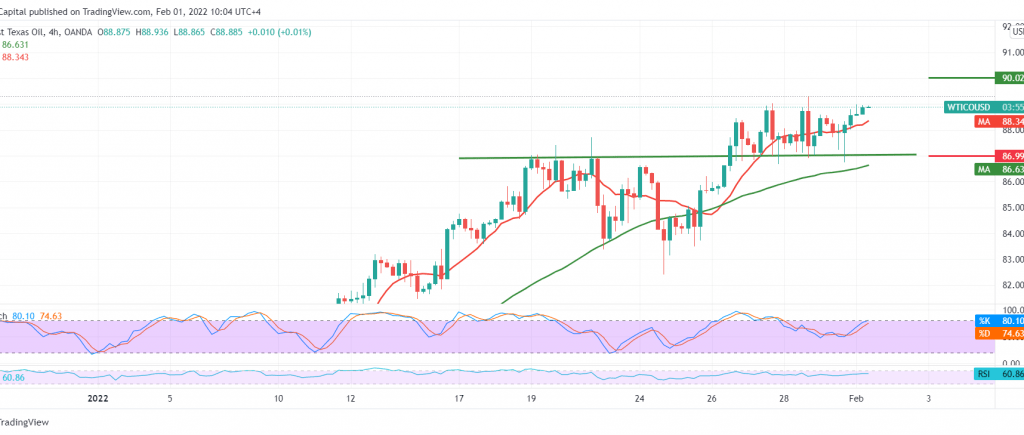

US crude oil futures prices maintained their gains within the bullish context published during the previous analysis after establishing a good support floor around the psychological support level of 87.00.

Technically, and carefully considering the 240-minute chart, we notice the continuation of the RSI’s defense of the bullish trend, stable above the mid-line 50, accompanied by a positive stimulus from the 50-day simple moving average.

Therefore, there is a possibility of a rise, as shown on the chart. Still, the price needs to confirm the breach of the pivotal resistance level 88.90, as we explained yesterday, and that is a catalyst that may extend the gains to visit 89.20 and then 89.90 as the next station as long as the price is stable above 87.00.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 87.00 | R1: 89.20 |

| S2: 85.50 | R2: 89.90 |

| S3: 84.80 | R3: 91.35 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations