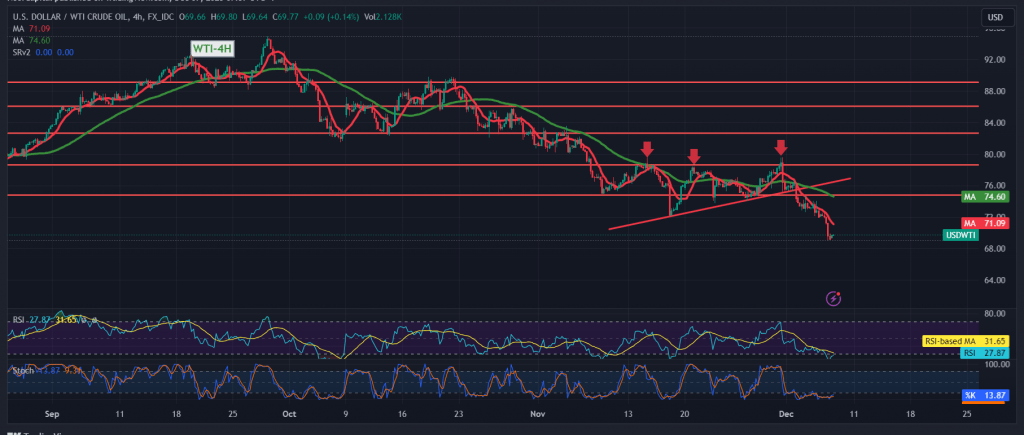

US crude oil futures prices incurred significant losses yesterday within the expected negative outlook during the previous technical report, touching the targets to be achieved at 70.70, recording its lowest level at $69.13 per barrel.

Technically, by looking at the 240-minute time frame chart, we notice continued negative pressure coming from the simple moving averages that continue to support the downward curve of prices, and are stimulated by the Relative Strength Index’s continued defense of the downward trend.

Therefore, the downward trend is the most likely during today’s trading, with trading remaining stable at the previously broken support and converted to the resistance level of 71.80, knowing that sneaking below 69.00 increases and accelerates the strength of the downward trend, opening the way directly for us to be waiting for 68.40 as a first target, and the losses may extend later towards 67.10.

Only from above is the return of trading stability above 71.80 with the closing of the hourly candle postponing the expected scenario and we may witness attempts to form a bullish attack whose targets begin around 73.80.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations