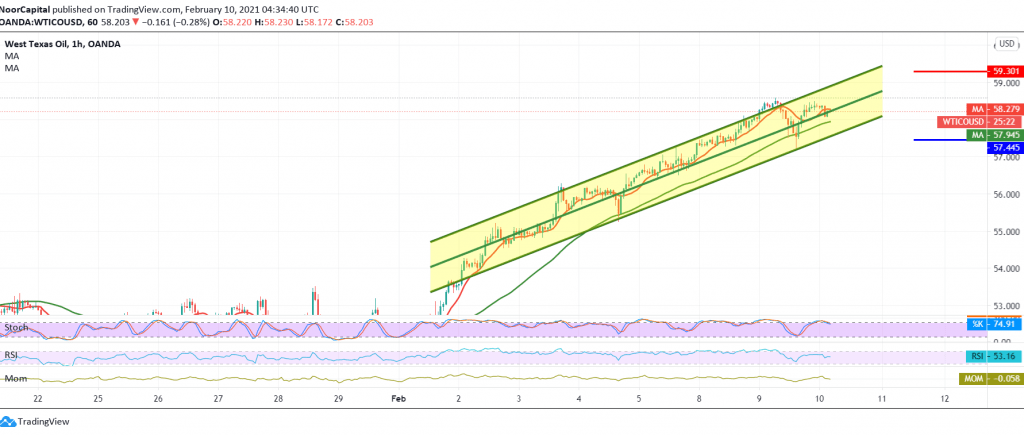

The upside continues to dominate the movements of US crude oil futures within a bullish path, as we expected it approached a few points difference from the first target required to be achieved mentioned in the previous analysis, at 58.80, recording its highest price of 58.60.

Technically, with the success of oil in retesting the support level at 57.50 and stability above, in addition to the price continuing to obtain a positive stimulus from the 50-day moving average.

This encourages us to maintain our positive outlook, knowing that the breach of 58.60 increases and accelerates and confirms the strength of the bullish trend, so that the way is directly open towards 59.40 and 59.70 respectively.

Activating the bullish scenario requires stability above 47.45, and breaking it is able to delay the bullish trend, and we are witnessing a slight bearish bias, targeting 56.60.

Warning: Stochastic is trading around the intraday overbought phase. Warning: Today we are awaiting the report from the International Energy Agency regarding oil inventories and we may witness high volatility in prices.

| S1: 57.45 | R1: 58.80 |

| S2: 56.65 | R2: 59.35 |

| S3: 56.05 | R3: 60.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations