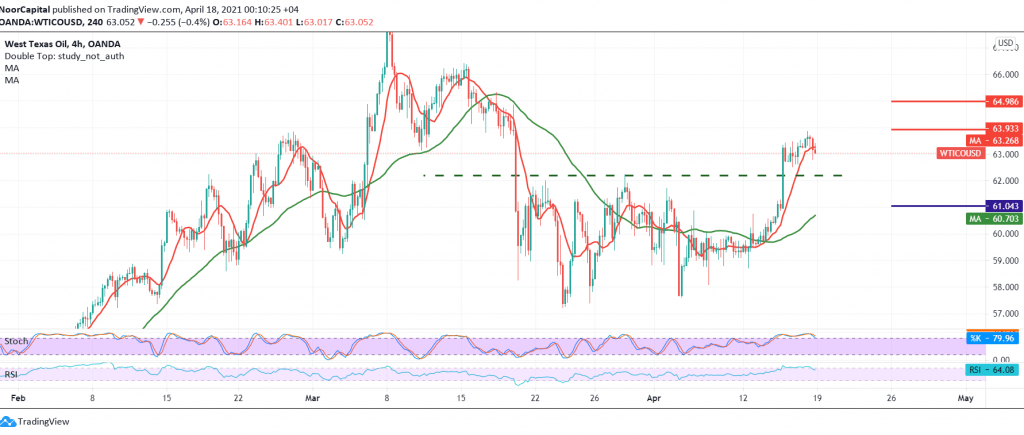

A gradual rise to the upside is controlling the futures price of US crude oil within a bullish path, as we expected it approached a few points difference from the first target at 64.00, to record its highest level during the previous session’s trading 63.84.

Technically, we are in front of a bullish technical structure, as we find the 50-day moving average that continues to support the upside. From here and steadily trading above 62.45 and in general above 62.00, targeting 64.00 a first target, and then 64.45 a next stop, its targets may extend later to visit 64.90.

Only from below is the confirmation of a breach of 62.00 capable of completely nullifying the bullish scenario, and we are witnessing a bearish bias targeting 61.20 before attempts to rise again.

Note: Stochastic is trading around overbought areas, and thus we may witness a bearish bias before achieving the bullish targets.

| S1: 62.45 | R1: 63.75 |

| S2: 61.80 | R2: 64.45 |

| S3: 61.10 | R3: 65.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations