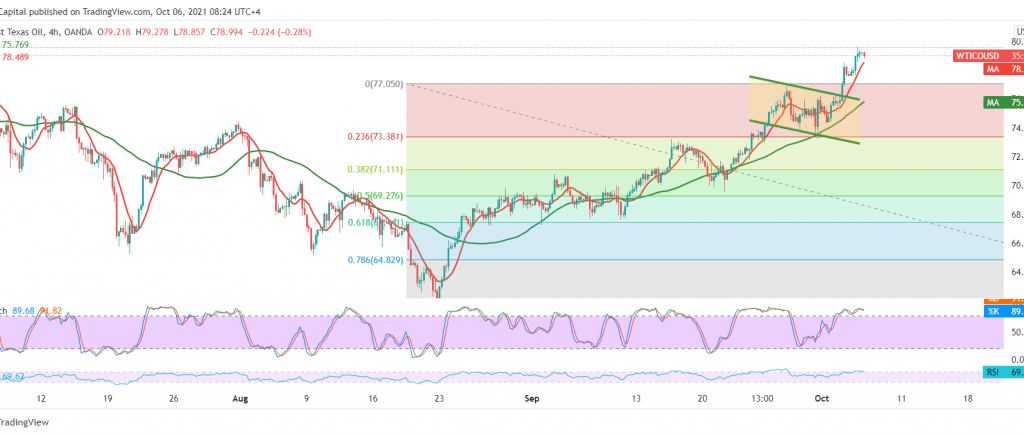

NYMEX crude futures prices achieved the extended target at 78.95, to record its highest level of 79.46.

Technically, by looking at the 60-minute chart, we notice that the stochastic indicator reached overbought areas and the stability of the intraday trading below 79.10.

We may witness a slight bearish tendency in the coming hours to retest 78.00 before completing the rise again. It should be noted that the technique of retesting the support mentioned above does not contradict the daily bullish trend, whose official targets are around 80.00 and 80.50, respectively, once 79.50 is breached.

In general, we expect to continue the bullish daily trend as long as trading is stable above the support level of 77.75, and breaking it will postpone the chances of rising. After that, we may witness a bearish slope targeting 76.70.

Note: The International Energy Agency report is due today, and we may witness high volatility in prices.

| S1: 77.75 | R1: 79.70 |

| S2: 76.65 | R2: 80.55 |

| S3: 75.83 | R3: 81.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations