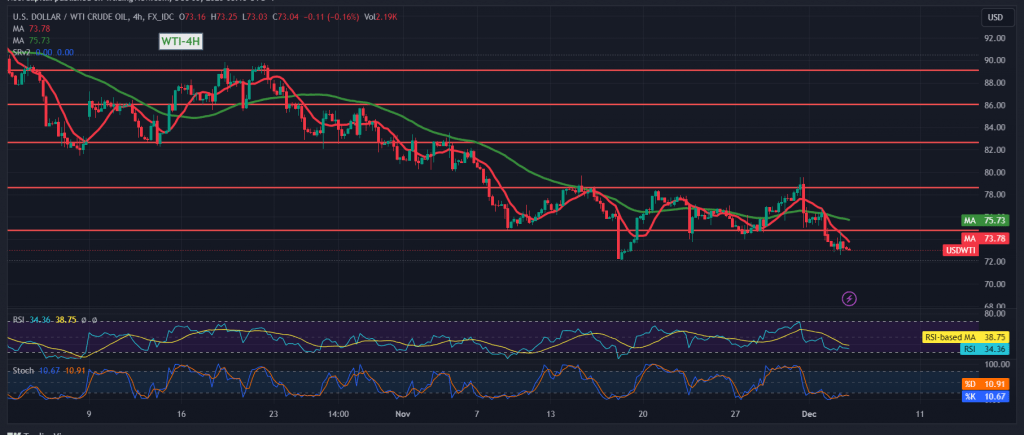

Negative dynamics prevailed in the prices of US crude oil futures contracts during the previous session, aligning with the anticipated bearish outlook outlined in the prior technical report. The market reached the initial target of $74.10 and neared, within a few points, the official station of $72.35, marking its lowest point at $72.66 per barrel.

From a technical perspective, a downward trend persists, fueled by sustained negative pressure from the simple moving averages exerting influence on the price from above. Additionally, intraday trading remains below the psychological barrier resistance of $74.00.

Consequently, the most probable scenario for today’s trading is a continuation of the downward trend. A breach below $72.60 would facilitate the task required to reach $72.15 as the initial target, with potential further losses extending to $71.20.

On the flip side, a return to stability above $74.50 would temporarily halt the downward trend, leading to a potential recovery in oil prices with the aim of retesting $75.00 and $75.40.

Caution: Today, high-impact economic data from the American economy is expected, including the ISM Services Purchasing Managers’ Index, job vacancies, and the labor turnover rate. Expect potential high fluctuation in prices during the news release.

Caution: The risk level may be high.

Caution: The overall risk level may be elevated due to ongoing geopolitical tensions, potentially resulting in increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations