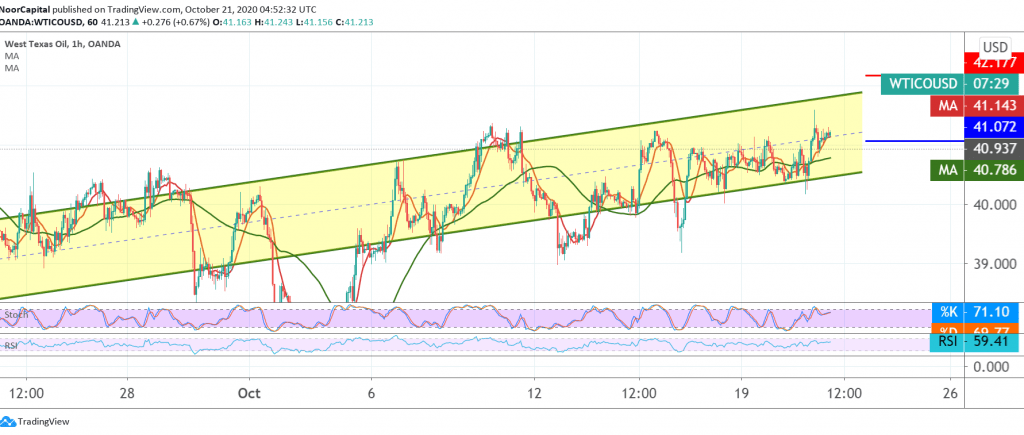

Positive trading overshadowed US crude oil futures prices. As we expected, the commodity touched the first target to be achieved in the previous analysis at 41.70, posting a peak at 41.87.

Technically, with trading stable above the previously breached resistance-into-support at 41.10, with bullish momentum from the RSI.

Therefore, the bullish scenario still intact, knowing that the breach of 41.80 will accelerate and confirm the strength of the trend today, paving the way towards 42.10 as an initial target, then 42.70, and may extend later towards 43.10.

Activation of the suggested scenario depends on trading remaining above 41.10, and breaking this level will postpone bullish chances with seeing a bearish slope targeting a re-test of 40.60 / 40.65.

Caution: Inventory data is due today from the International Energy Agency and may cause volatility in price movement.

| S1: 40.65 | R1: 42.10 |

| S2: 39.80 | R2: 42.70 |

| S3: 39.25 | R3: 43.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations