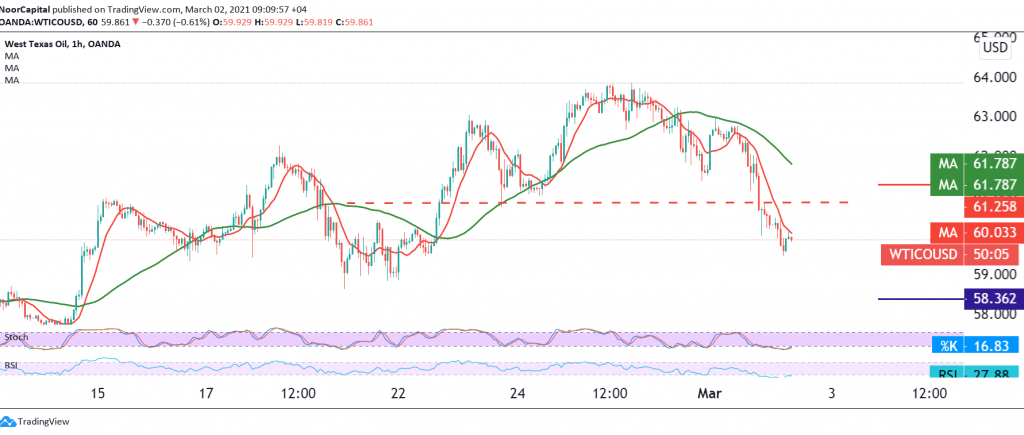

The negative moves regained its control over the futures price of US crude oil after it failed to maintain trading levels above 62.00, indicating that the price stability below it will immediately stop the intraday bullish attempts and put the price under negative pressure again, its targets start around 61.30 and extend to 60.20, posting a low of 49.45. .

Technically speaking, with the break of the mentioned support level, which is accompanied by negative pressure from the moving averages constituting an obstacle for oil. This increases the chances of continuing the bearish trend, with the first target at 58.60 followed by 58.20, respectively.

Only from above, the restoration of trading stability above 61.30 will stop the suggested bearish scenario, and oil will recover aiming to retest the 62.10 level.

| S1: 58.60 | R1: 62.10 |

| S2: 57.30 | R2: 64.20 |

| S3: 55.20 | R3: 65.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations