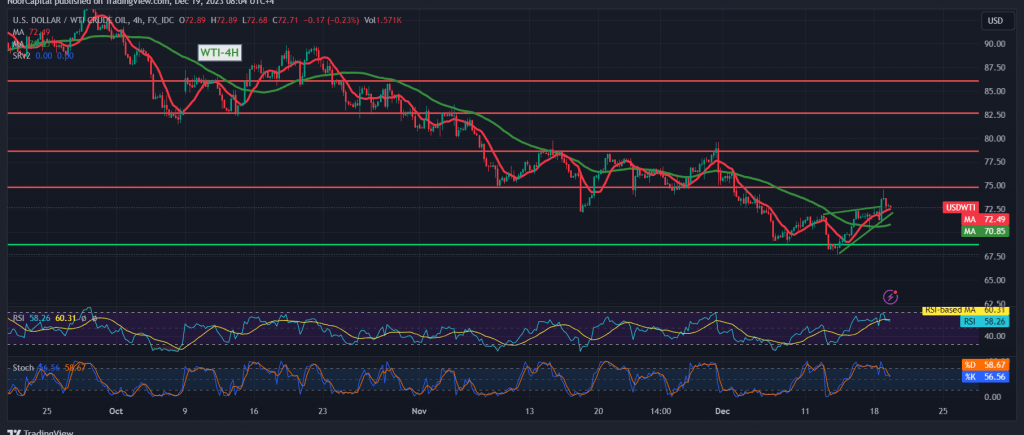

Positive momentum characterized the trading of US crude oil futures contracts in the initial sessions of this week, reaching its pinnacle at $74.60 per barrel.

From a technical standpoint, the price of oil has successfully established a solid foundation above the robust support level at 71.40. The ongoing support from simple moving averages further reinforces the upward trajectory of prices.

Given these technical indicators, there exists a potential for a continued upward trend in today’s trading session. This scenario is contingent upon a clear and robust breach of the 74.55 level, which could extend the gains, paving the way directly towards 75.00 and 76.00, respectively.

Conversely, a return to trading stability below 71.40, confirmed by the hourly candle closing below this threshold, would interrupt the upward trend, subjecting the price to substantial negative pressure. The initial downside target in such a scenario is 70.95, with a subsequent extension towards 69.20.

Warning: The risk level is deemed high.

Warning: Heightened risk is associated with ongoing geopolitical tensions, potentially leading to increased price volatility. Caution and prudent risk management are advised in navigating the current market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations