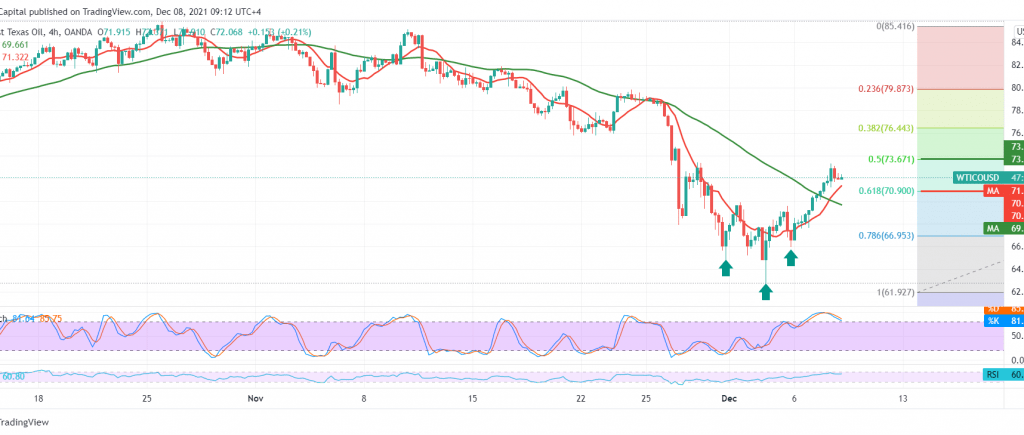

US crude oil futures prices jumped during the bullish correction, touching the first official target of 70.80, explaining that its breach extends oil gains towards 71.30 to record its highest level during yesterday’s session around the psychological barrier of 73.00.

Technically, trading stability is above the previously breached resistance-into-support at 70.80, 61.80% Fibonacci correction that supports the rise, in addition to the positive motive for the 50-day moving average, which returned to hold the price from below.

From here, we maintain our positive expectation on an intraday basis, targeting 73.70, 50.0% correction. If breached, a first target will increase the bullish correction strength and open the door to visit 74.50.

Activating the above suggested bullish scenario depends on the stability of daily trading above 70.80 and, most importantly, 70.30.

Note: the level of risk is high.

Note: IEA oil stocks are due today and may cause volatility.

| S1: 70.30 | R1: 73.20 |

| S2: 68.70 | R2: 74.55 |

| S3: 67.40 | R3: 76.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations