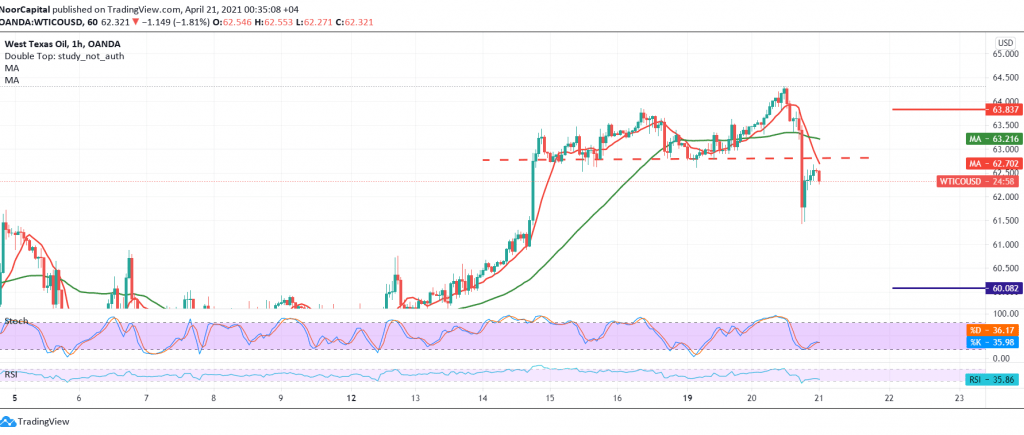

US crude oil futures prices retreated significantly within the negative outlook, as we expected, touching the second target of 62.30, to record its lowest price during the previous trading session at 61.43.

Technically, there is a clear breach of 62.80 and the RSI indicator continues to defend the bearish bias, in addition to the negative pressure of the simple moving averages.

Consequently, we will maintain our negative outlook targeting 61.20. We should also pay close attention to the fact that breaking the latter increases and accelerates the strength of the bearish bias so that the way is directly open towards 59.80 for the next station.

From the top, the price will return to stability and rise again above 62.80 and the most important 63.10 will stop the bearish bias and oil recover with an initial target of 64.10.

Note: IEA Report is due today and may witness price volatility.

| S1: 61.20 | R1: 64.10 |

| S2: 59.80 | R2: 65.65 |

| S3: 58.30 | R3: 67.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations