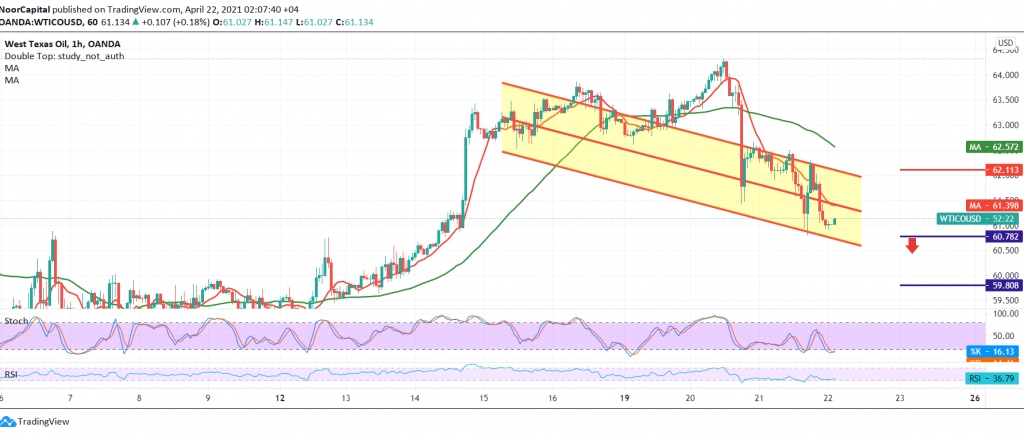

US crude oil futures prices retreated significantly within the expected bearish path during the previous analysis, touching the first official station 61.10, recording a low of 60.80.

Technically, the negative pressure on oil prices continues, the moving averages continue to pressure from the top, in addition to the RSI gaining bearish momentum.

Therefore, we will maintain our negative outlook, continuing towards the second target of the last analysis, provided that 60.80 breaks, targeting 60.40, and then 59.80.

Only from the top, a breakout to the upside, and a rise above 62.20/62.30 is able to foil the bearish scenario and lead the price of oil to re-test 63.10/63.30 resistance.

Note: Stochastic is around oversold areas.

| S1: 60.40 | R1: 62.10 |

| S2: 59.75 | R2: 65.65 |

| S3: 58.70 | R3: 67.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations