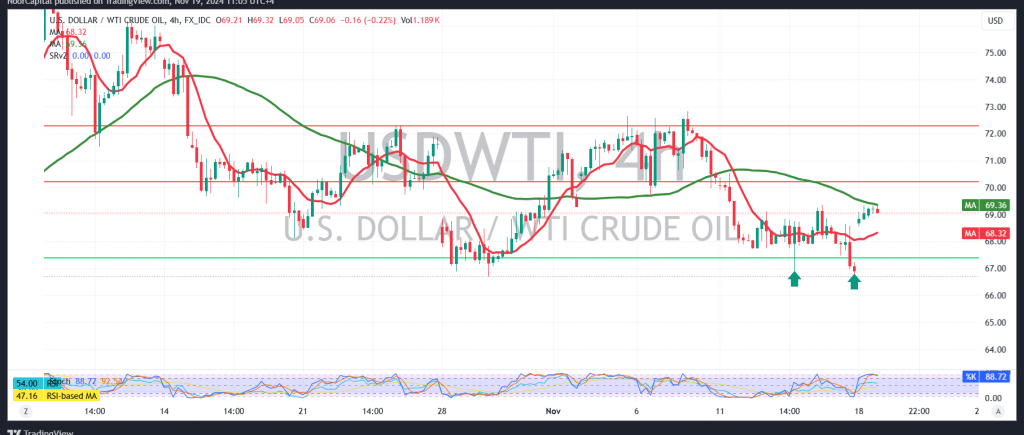

US crude oil futures have shown a strong upward momentum, crossing a key resistance level at 68.65, signaling a shift toward a potential bullish trend.

Technical Analysis Overview:

On the 240-minute chart, the technical setup is promising, with the 14-day momentum indicator attempting to generate positive signals. Furthermore, the 50-day simple moving average is lending support to the price, aiming to sustain the upward movement.

- Upward Scenario: As long as oil prices remain stable above the newly established support at 68.65, there is a likelihood of continuing the uptrend. Initial targets include 69.40 and subsequently 70.10, with an extension toward 71.10 if the bullish momentum persists.

- Risk of Downtrend: Should oil prices drop and sustain a close below 68.65 on an hourly basis, this would invalidate the bullish outlook, potentially reverting to a downward trajectory with a primary target of 67.60.

Warnings and Considerations:

The trading environment remains risky, particularly with heightened geopolitical tensions that could lead to unexpected market fluctuations. Hence, careful risk management is essential.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations