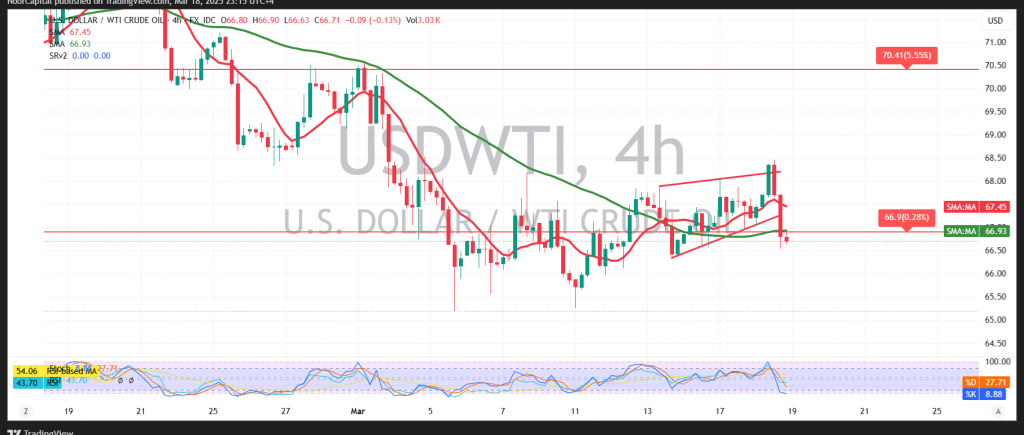

U.S. crude oil futures have staged a strong rebound, aligning with the anticipated positive outlook from the latest technical analysis. A breakout above $67.20 acted as a catalyst, driving prices higher to a peak of $68.45 per barrel.

From a technical perspective, the outlook remains cautious with a slight bearish inclination. The return to stable trading below $67.20, combined with a sustained negative crossover in the simple moving averages and bearish signals from the 14-day momentum indicator, suggests potential downside risks.

In the short term, further declines could lead to a test of $66.10, with a break below this level potentially extending losses toward $65.40. However, if prices regain stability above $67.25, the downside scenario may be invalidated, paving the way for a recovery toward $67.90 and $68.40.

Today’s session is expected to see heightened volatility due to key U.S. economic events, including the Federal Interest Rate Decision, Federal Reserve Statement, Federal Reserve Chairman’s Press Conference, and the Federal Reserve Economic Outlook. These developments could significantly impact oil prices.

With ongoing trade tensions and economic uncertainty, market risks remain elevated, and multiple scenarios are possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations