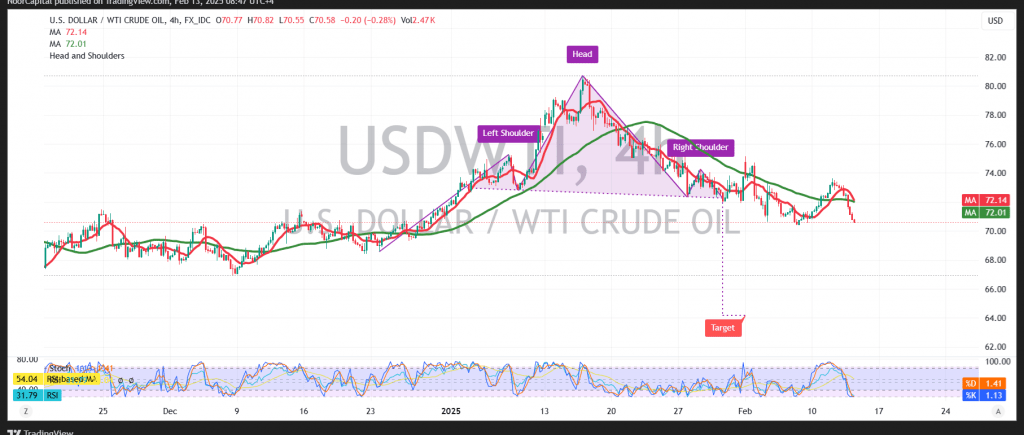

US Crude Oil Price Analysis

US crude oil declined sharply after failing to hold above $73.00 per barrel for an extended period.

Technical Outlook:

- Bearish Indicators:

- The 4-hour chart shows clear selling pressure at the open.

- Negative crossover of simple moving averages is weighing on prices.

- A bearish technical structure is evident.

- Bullish Recovery Scenario:

- A break above 72.30 could lead to a temporary rebound toward 73.70.

Key Levels to Watch:

- Bearish Scenario:

- First target: $70.00

- Break below 70.00: Further downside toward $69.70

- Extended losses: Potential decline to $68.80

- Bullish Reversal:

- A return above 72.30 could indicate a recovery attempt toward 73.70.

Market Risks & Considerations:

- US economic data release (Producer Price Index, Weekly Unemployment Claims) could lead to high price volatility.

- Trade tensions continue to pose risks, making oil prices highly unpredictable.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations