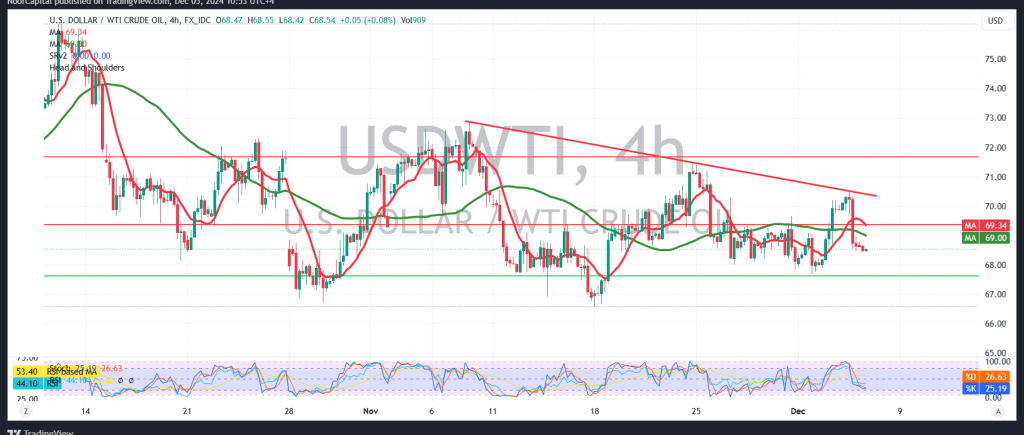

US crude oil futures demonstrated the anticipated upward trend outlined in the previous technical report, supported by trading stability above the key level of 68.90.

Technical Analysis:

- Bearish Indicators:

- The simple moving averages apply continued downward pressure.

- The 14-day momentum indicator reflects clear negative signals, favoring a bearish outlook.

Scenario Analysis:

- Bearish Scenario (Most Likely):

- Stability of intraday trading below 68.90 supports a downside trajectory.

- A break below 68.60 is critical to confirm the bearish outlook, targeting 67.75 initially, followed by 67.10.

- Bullish Alternative:

- An upward breakout and stability above 68.90 could negate the bearish scenario, prompting upward moves toward 69.80 and potentially 70.60.

Key Considerations:

Risk Warning:

Elevated risk levels due to ongoing geopolitical tensions could lead to unpredictable price movements. Ensure risk management measures are in place.

High-Impact Economic Events:

The release of U.S. “Weekly Unemployment Claims” data today may introduce heightened volatility, influencing crude oil prices significantly.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations