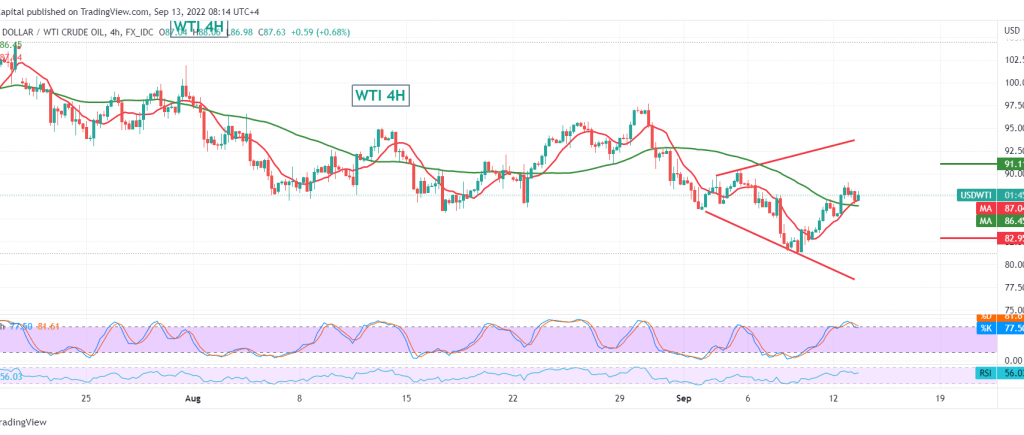

US crude oil futures prices jumped during the previous trading session, nullifying the negative outlook as we expected, in which we relied on the stability of trading below 86.40, explaining that skipping upwards and consolidating above 86.40 leads oil to complete the bullish correction. We wait for touching 87.50 and 88.30, recording the highest level of 89.06.

On the technical side today, we find a contradiction between the positive motive coming from the 50-day simple moving average, which continues to hold the price from below, and the clear negative signs on stochastic.

Therefore, we prefer to monitor the price behaviour of oil and wait for the activation of the following pending orders:

To resume the bullish correction path, we need to witness a decline in the price again above 88.40, which may enhance the chances of a rise towards 89.45, and gains may extend later towards 91.10.

Below 85.40/85.60 we are witnessing a solid bearish trend that leads oil to retest 83.45 and 82.00.

Note: High risk

Note: US inflation data is due out today through CPI, it has a big impact, and we may see price swings.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations