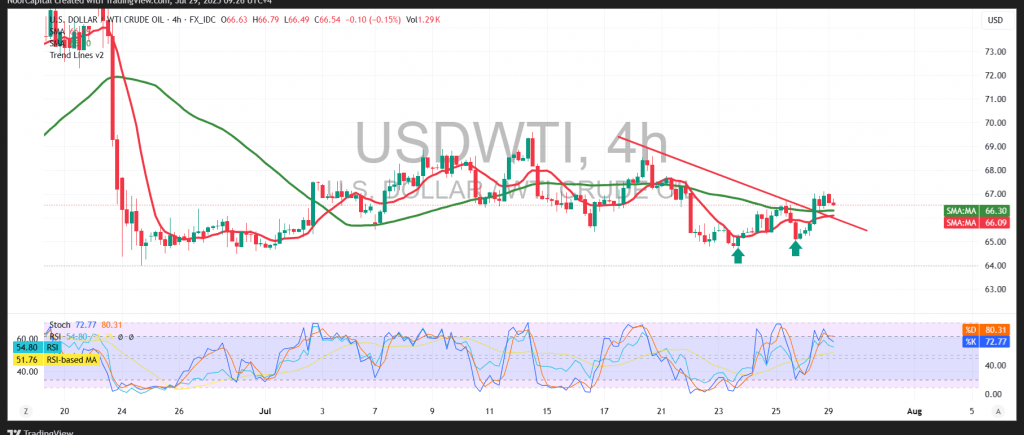

U.S. crude oil (WTI) futures started the week on a positive note, attempting to establish a technical rebound after testing a key support level at $65.10 per barrel.

Technical Outlook:

WTI is currently holding above the psychological support of $65.00, reinforcing bullish recovery attempts. This is supported by price stability above the 50-period Simple Moving Average (SMA), which acts as a dynamic support for the ongoing upward momentum.

However, the Relative Strength Index (RSI) is showing signs of waning bullish momentum after entering overbought territory. This suggests a degree of buyer hesitation to extend gains further.

Likely Scenario:

Given the mixed technical signals, it is prudent to closely monitor price action for confirmation of one of the following scenarios:

- Bearish Scenario:

A confirmed break below the $65.40 support level could renew selling pressure, opening the path toward the next support zone near $64.30. - Bullish Scenario:

A break above the minor descending trendline would likely signal renewed bullish momentum, with potential upside targets at $67.40, followed by $68.20, especially if the price remains stable above these levels.

Warning: Risk remains elevated due to ongoing trade and geopolitical tensions. Volatility is high, and both bullish and bearish outcomes are possible.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations