Positive attempts dominated the prices of US crude oil futures contracts, trying to compensate for its recent losses, recording its highest level during yesterday’s trading session, around $71.74 per barrel.

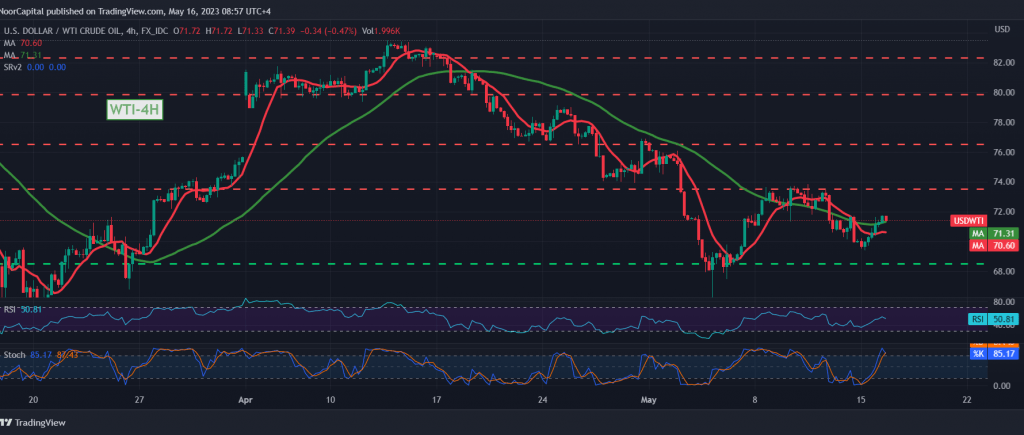

Technically, we tend to be negative in our trading, relying on the negative intersection signs of the stochastic indicator, which shows overbought signs on the 4-hour time frame, in addition to the stability of intraday trading below 71.60-71.80.

Therefore, there is a possibility of a decline during the coming hours, targeting 70,000 as the first target, and breaking it increases and accelerates the strength of the bearish trend, opening the door to 68.60 awaited target and reminding you that activating the suggested scenario requires stability in daily trading below the resistance level of 71.80.

Note: Today, we are waiting for high-impact economic data issued by the US economy, “US retail sales,” and from the United Kingdom, we are waiting for “the change in unemployment benefits” in addition to “inflation data” from Canada and the speech of the President of the European Central Bank, and we may witness high volatility in prices at the time Release the news.

Note: The level of risk is high and does not match the expected return, and scrutiny is required, noting that all scenarios are likely to occur.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations