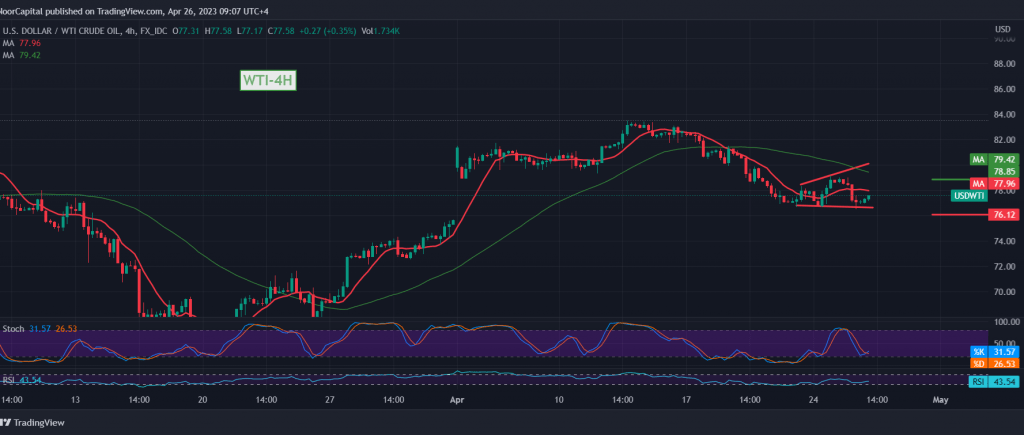

Negative movements continue to put pressure on the prices of US crude oil futures within the expected bearish context, touching the first target to be achieved during the previous technical report at the price of 77.20, recording its lowest level at $76.60 per barrel.

Technically, the bearish direction during today’s trading session is the most preferable, depending on the continuation of the negative pressure coming from the simple moving averages in conjunction with the clear negative signs on the RSI.

From here, with steady daily trading below the strong resistance level of 78.80, we expect more decline, targeting 76.40 as the first target, and the price may head to touch the second target of the previous report, 76.10 unless we witness any trading above 78.80.

To remind you, the attempt to breach 78.80 completely invalidates the activation of the suggested scenario, and oil starts building a rising wave, with its initial target at 80.10.

Note: Today, we are awaiting the report issued by the International Energy Agency regarding oil inventories, and we may witness high fluctuations at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations