US crude oil futures prices continue to achieve losses, and oil starts with negative movements with the first trading of this week, and the current movements are witnessing stability around its lowest level during the morning trading of the current session at 78.80.

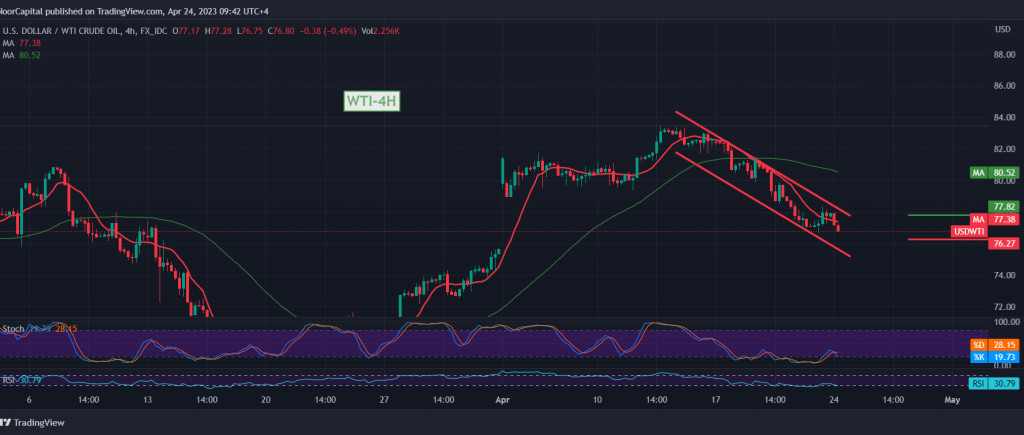

Technically, prices are still operating within the descending channel as shown on the 240-minute chart, and we find the simple moving averages continue the negative intersection and pressure on the price from above, stimulated by the negative signals of the stochastic.

The bearish scenario is the most favorable, with daily trading consolidating below 77.80, targeting 76.30, the awaited price station.

Only from above is an attempt to breach the resistance level of 77.80, which can thwart the bearish scenario and lead oil to compensate for the loss of a visit to 78.80.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations