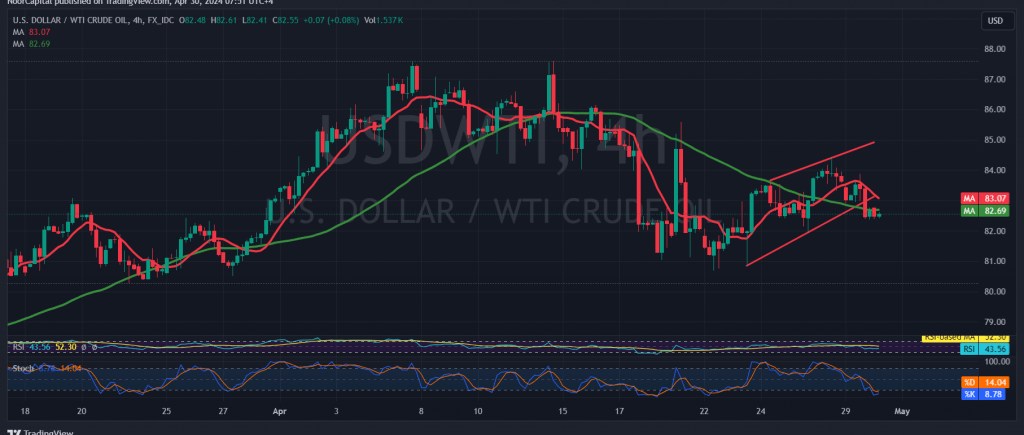

US crude oil futures prices experienced downward pressure at the beginning of the trading week, encountering resistance near the psychological threshold of $84.00.

From a technical perspective, a bearish outlook emerges, driven by the resurgence of simple moving averages exerting downward pressure, coupled with the price’s positioning below key sub-resistance levels at 83.50 and, notably, 83.90.

Consequently, the price trajectory is likely to continue its downward correction, with an initial target set at $82.00. A breach below this level could intensify and accelerate the downward correction, with the next significant support anticipated at $81.50.

It’s important to note that a consolidation above $83.90 has the potential to disrupt the bearish scenario, leading to a temporary recovery in oil prices and a possible ascent towards $84.40 and $84.90.

Traders should exercise caution today, as high-impact economic data from the American economy, including the “Employment Cost Index” and “Consumer Confidence Index,” are scheduled for release. This could result in increased price volatility.

Moreover, persistent geopolitical tensions add to the level of risk, potentially contributing to heightened price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations