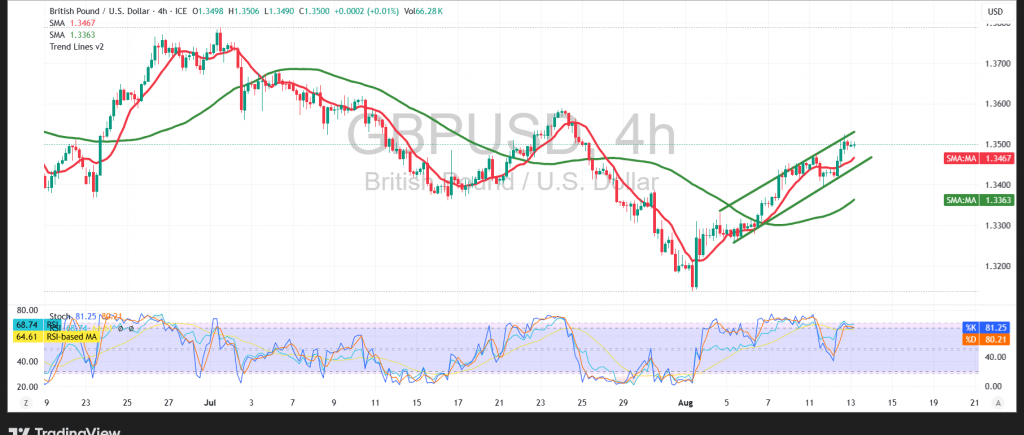

The GBP/USD pair continues its gradual upward movement, reaching a high of 1.3524 in the previous trading session.

Technical Outlook – 4-hour timeframe:

The pair’s stability above the simple moving average, which coincides with the support area near 1.3470, strengthens this level as a key pivot point. Additionally, the Relative Strength Index (RSI) has exited overbought territory, allowing for renewed bullish momentum and increasing the potential for further gains.

Likely Scenario:

As long as the price holds above the pivotal support at 1.3470, and more importantly above 1.3445, the bullish bias remains favored. The next upside targets are 1.3545 as initial resistance, followed by 1.3570. Conversely, a confirmed break below 1.3470, with an hourly close under this level, could trigger temporary downward pressure toward 1.3450, with a possible extension to 1.3380.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations