Gold concluded the week on a strong upward trajectory, recording significant gains driven by the weakness of the U.S. dollar. This performance was further bolstered by diminished risk appetite in financial markets and reports highlighting a substantial increase in central bank purchases of the precious metal.

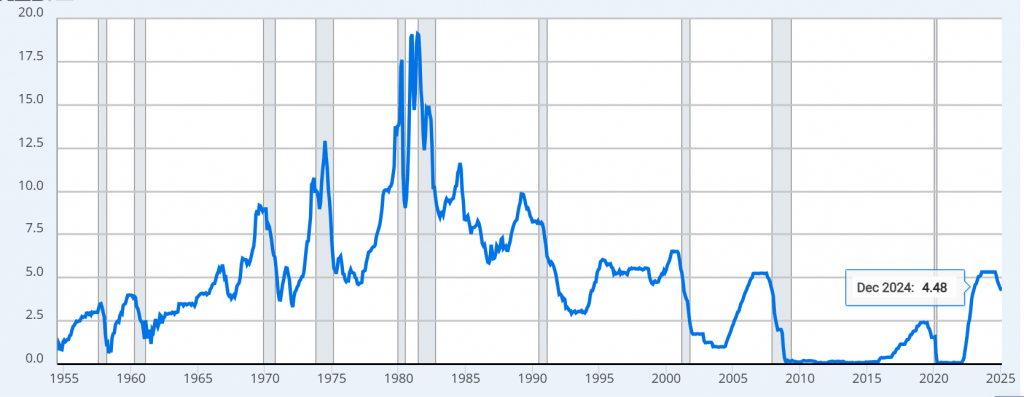

Several factors contributed to the U.S. dollar’s weekly decline, most notably trade tensions stemming from tariff disputes and the ongoing U.S.-EU debate over trade restrictions throughout the past week. Additionally, U.S. inflation data highlighted a slowdown in the pace of price growth across consumer and producer levels. Unsurprisingly, these developments negatively impacted the dollar, prompting investors to lean toward the likelihood of an interest rate cut before the end of 2025.

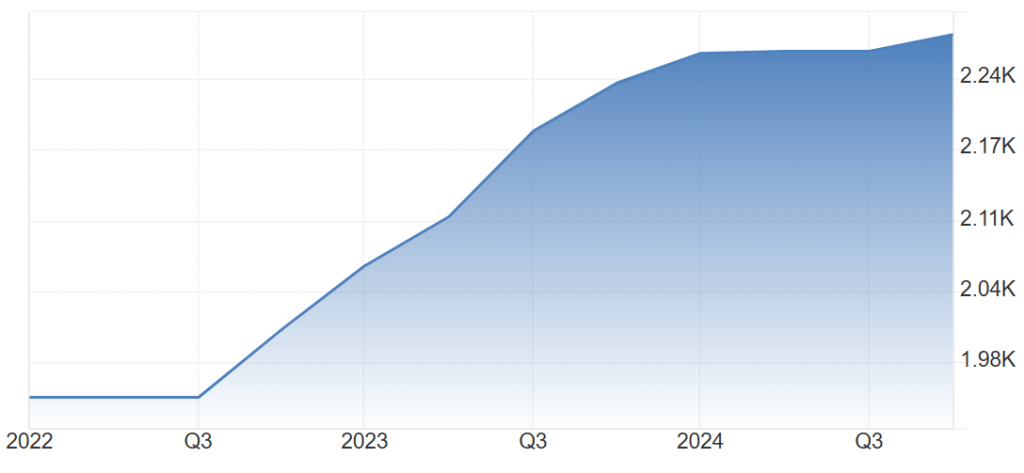

Gold futures rose by 2.6% at the close of trading for the week ending March 14, reaching $2,993 per ounce, compared to the previous week’s closing price of $2,917 per ounce.

Gold recorded its lowest level during last week’s trading at $2,882, compared to a peak of $3,017 over the same period. This performance marked a breakthrough, surpassing all previous resistance levels and achieving an unprecedented all-time high.

Reports said that central banks worldwide are intensifying their gold purchases at present. The World Gold Council revealed that the People’s Bank of China and the National Bank of Poland recently added 10 tons and 29 tons of gold, respectively, to their strategic reserves.

China’s gold reserves increased to 73.45 million ounces at the end of January, compared to 73.61 million ounces at the close of the previous month. This highlights the Chinese central bank’s sustained purchasing activity for the fourth consecutive month.

Central banks, among the most significant buyers of gold, purchased approximately 1,000 metric tons of the metal in 2024. According to the World Gold Council, these institutions are expected to continue their gold-buying activity throughout this year.

A tragic downfall for the dollar

Three key factors influenced the movement of the U.S. dollar throughout the week ending Friday, March 14: escalating trade tensions between the United States and the European Union, February’s U.S. inflation data, and the United States successfully avoiding the risk of a government shutdown.

The U.S. Consumer Price Index (CPI) recorded increases of 0.2% on a monthly basis and 2.8% on an annual basis in February, falling short of market expectations of 0.3% and 2.9%, respectively.

Core inflation readings, which exclude food and energy prices, also came in below expectations, rising by 0.2% on a monthly basis and 3.1% on an annual basis, compared to market forecasts of 0.3% and 3.2%, respectively.

Producer price inflation in the United States declined, as confirmed by February’s readings, which showed the Producer Price Index (PPI) remaining flat at 0.0% for the month, compared to the previous month’s reading of 0.6%. This result came in below market expectations, which had forecast a 0.3% increase.

The annual reading rose to 3.2% in February, compared to the previous reading of 3.7%. However, it fell short of market expectations, which had projected 3.3%.

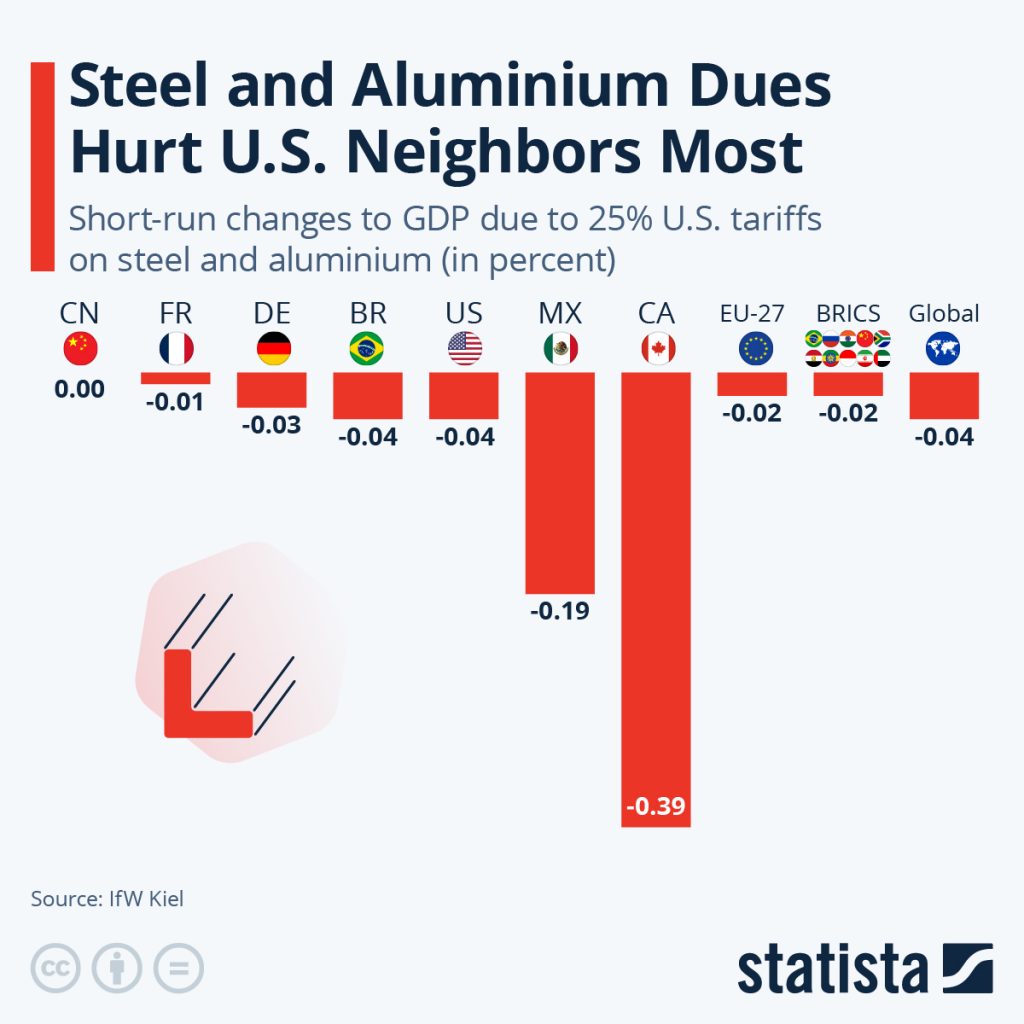

Trump reignited the trade war on a new front by reinstating tariffs on U.S. imports of European steel and aluminum tariff originally imposed during his first term in 2018. This move dealt a blow to the U.S. dollar.

The United States narrowly avoided a potential government shutdown after a last-minute agreement was reached to pass a bill funding federal government activities, which was signed into law by President Donald Trump last Saturday. This development boosted risk appetite in the markets on the final trading day of last week, following statements by Chuck Schumer, the Senate Democratic leader, who assured that he would not oppose the temporary funding bill previously passed by the House of Representatives.

EURO and Pound

The euro capitalized on the U.S. dollar’s weakness for most of last week’s trading, further benefiting from positive political developments, including proposals to increase defense and infrastructure spending by tens of billions.

Germany’s Green Party has expressed its willingness to engage in negotiations to reach an agreement on the disputed defence spending plans among the potential coalition government partners in Germany.

The financial plans unveiled by Friedrich Merz, the anticipated German Chancellor, and the potential ruling coalition—which include allocating €500 billion for defense and infrastructure spending to bolster economic performance—have provided a significant boost to the euro in recent days.

Leading these efforts is Friedrich Merz, head of the Christian Democratic Union, who has reached an agreement with his prospective coalition partners to propose legislation aimed at increasing defense spending in the eurozone’s largest economy.

The euro also capitalized on the U.S. dollar’s weakness, extending its gains for the third consecutive trading day. This upward momentum was driven by spending and fiscal reform plans that would enable Germany to increase its expenditures by amending constitutional provisions related to the “debt brake,” a term referring to the maximum borrowing limit for Germany’s federal government, akin to the U.S. debt ceiling.

Additionally, the European Union discussed a proposal to allocate €150 billion in loans to support and enhance defense spending across the eurozone. Member states were also encouraged to utilize their national budgets to provide an additional €650 billion over four years to strengthen military and defense expenditures. These developments contributed to the euro’s notable weekly gain of approximately 0.4% as of March 14.

Meanwhile, the British pound rose by about 0.2% over the week, buoyed by optimism stemming from the avoidance of potential trade tensions with the United States. Notably, President Donald Trump did not include the United Kingdom among the countries he mentioned when discussing the imposition of tariffs.

Cryptocurrencies

It is widely anticipated that certain market factors could drive Bitcoin to higher levels, despite forecasts suggesting the possibility of the leading cryptocurrency by market capitalization declining to around $75,000 per unit.

Bitcoin ended Friday’s trading on an upward trajectory, buoyed by factors indicating a potential recovery in the near term. These include renewed inflows into exchange-traded funds (ETFs) and increased likelihood of interest rate cuts before the end of the year.

Following an outflow of approximately $1.6 billion from spot Bitcoin ETFs, these funds saw an inflow of about $13 million last Wednesday. This marks the first notable inflow into such investment vehicles in March. While this initial inflow of $13 million supported Bitcoin’s rise, the figure pales in comparison to the $1.6 billion lost by these funds over seven days.

Nevertheless, the return of investment inflows to Bitcoin ETFs highlighted a positive reaction from global financial markets to U.S. consumer inflation data, which came in below market expectations for February.

Data released last week further fueled expectations of a Federal Reserve rate cut before the end of 2025. Such a move would likely weaken the dollar and improve risk appetite in the markets. Bitcoin and other cryptocurrencies often benefit from improved market sentiment and share a positive correlation with the S&P 500 Index.

Government shutdown

President Donald Trump signed a temporary funding bill for federal government activities in the United States after it was passed by both the House of Representatives and the Senate. The president’s signature last Saturday turned the proposed legislation into binding law, allowing the country to avoid a government shutdown.

This law ensures funding for federal institutions for six months, maintaining government spending at the same levels as during President Biden’s administration. However, there were minor adjustments, including a $13 billion reduction in non-defense spending and a $6 billion increase in defence spending.

The total government expenditure in the United States is estimated at approximately $1.7 trillion. The Senate passed the temporary funding bill last Friday with a 54-46 vote, with ten Democrats voting in favor of the proposed legislation despite their party’s opposition.

This week

The Federal Open Market Committee (FOMC) meeting, which spans two days, is set to conclude next Wednesday. Market expectations suggest that the Federal Reserve is unlikely to make any adjustments to interest rates. However, investors in global financial markets will closely scrutinize remarks by the Chair of the Federal Reserve Board for insights into the future direction of monetary policy.

Earnings reports also hold a significant place among next week’s market-moving events. These include results from major companies such as Nike, Micron Technology, and FedEx, among others, as the market anticipates potential impacts related to tariff measures.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations