It was a very busy week in financial markets as US president Donald Trump continues escalation of his trade attacks on a large number of states, which ended in a 90-days pause of tariffs enforcement on all countries, excluding China which was targeted by the maximum duties with “immediate” enforcement.

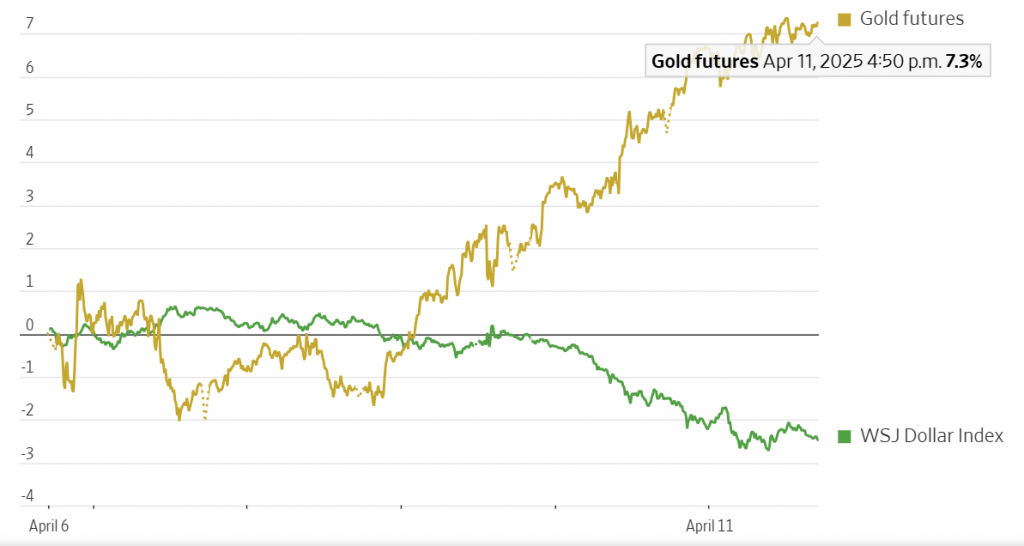

The most significant about price action in the markets was the enormous surge of gold, which recorded two new all-time highs.

US stocks also made remarkable gains buoyed by financial sector earning which proved to be positive in spite of difficulties the sector recently encounters.

Yields of T-notes also made records because of the heavy selloff of the treasuries.

Cryptos were among the winners too last week because of its positive correlation with risky assets.

Gold was undefeated

Gold made two all – time highs last week, ending last week trading at levels above $3250 per ounce.

Making use of US dollar weakness throughout the week, gold made its first all- time high of $3170 per ounce.

The precious metal extended its gains amid fears of more escalation of trade tensions between Washington and Beijing. Weekly gains of the precious metal were 6.5%.

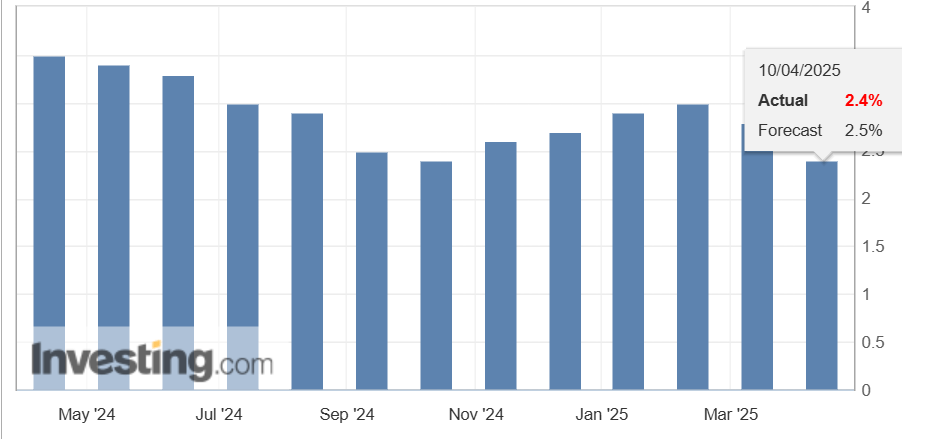

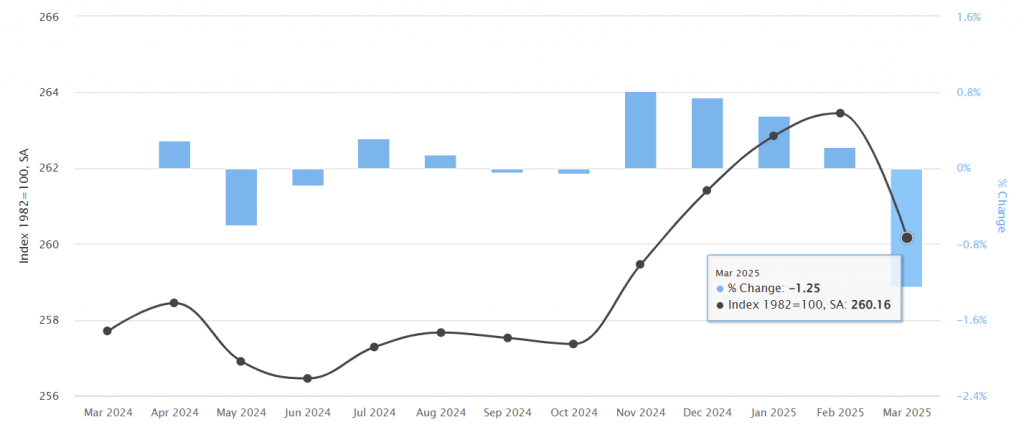

US Data and earnings

US consumer price index (CPI) fell 0.1% and 2.4% in March and over the last 12 months respectively. The reading excluding food and energy increased 0.1% and 2.8% in March and over the year respectively.

Meanwhile, producer price index (PPI) decreased -0.1% and 3.3% in March and over the year respectively.

The above readings were positive for risky assets, which supported risk appetite as investors in wall street, for instance, were eager to any positive notes in markets.

Earnings of several companies in the financial sectors brought about the optimism they wanted, then they took US stocks to record high and record trading volumes.

A number of financial groups reported earnings topping market expectations, including JP Morgan Chase and Morgan Stanley.

US Dollar was very weak

The greenback position among safe havens was hard hit by retracement of confidence in US assets because of Trump’s trade policies, which puts world economy the verge of a new crisis.

This could be the case for a while after the currency staged weekly losses 3.00%.

US bond yields made record highs

US T-notes extended gains buoyed by diminishing confidence in US assets, especially T-notes, which started to diminish, triggering heavy selloff in treasuries.

The surge was due to the inverse correlation among yields and value of the US sovereign securities as selloff led to lower value and subsequently higher yields.

The yields made two new record highs; 10Ynotes rose to the highest level since 2001 and 30Ynotes rose to the highest levels since 1982.

Japanese is still rallying

Japanese yen is still in the uptrend due to stronger demand on safe haven assets while avoiding US dollar, which is losing investors’ confidence due to Trump trade policies.

The confidence in US dollar could continue deteriorate if there is any further escalation in trade tension.

Although president Donald Trump is trying to mitigate the negative impact of his trade policies – exempting smartphones, computers from the new tariffs – there could be further escalation if nothing positive circulated about potential negotiations between USA and China.

Euro is making use of dollar weakness

The single currency made the best use of dollar weakness, which was hard hit by a confidence crisis in US assets because of Trump’s administration trade policies.

As a risky assets, Euro added 2.7% after President’s Trump’s pausing tariffs for 90 days and declining to rule out an extension of this period. This is also applied to pound sterling, which made gains supported by dollar slump.

Bitcoin rose on positive correlation

Bitcoin added almost 6.00% last week due to its positive correlation with S&P500, which made a weekly record supported by earnings.

This week

This week, markets are waiting important date, including housing, industry, and retail sales indicators.

Financial sectors will also release more earning reports, including Bank of America and Goldman Sachs. Netflix will also release its financial performance report in Q1 of 2025.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations